The sale of Future Lifestyle Fashions (FLFL) under the corporate insolvency process has run into a roadblock due to a conflict of interest between promoter Kishore Biyani and the forensic auditor appointed by lenders, people aware of the development said. Dilip Dixit had undertaken an assignment for one of the Biyani-promoted company before FLFL was admitted for corporate insolvency. Dixit is also partner of GD Apte & Co, the firm which the lenders appointed as forensic auditor of FLFL in July 2022.

This has resulted in a conflict of interest, according to a petition filed by Biyani. A division bench of the Bombay HC on August 11 ruled that neither Dixit nor GD Apte & Co should undertake the forensic auditor’s role for FLFL. Lenders are now preparing to appoint another forensic auditor to expedite the sale of the company under corporate insolvency. “Thus, it is a setback since a year is lost waiting for the report,” a senior bank official said.

“Although the RP can proceed with the sale process, the extent of recovery will be known after a forensic report is tabled before lenders for review,” the banker said. Forensic audit helps lenders gauge if promoter has undertaken any preferential or fraudulent transactions that can be clawed back. Lenders plan to seek an explanation from GD Apte & Co as to why it did not disclose the assignment undertaken by a Future Group company. “Lenders may consider not giving new assignments to firms that do not disclose conflict of interest,” said the lender cited above.

GD Apte & Co in response to ET query claimed they have “suo-moto declined the assignment as forensic auditors of FLFL” and denied any conflict of interest. “Thus, there arises no question of withholding any such data from the lenders.”

State Bank of India (SBI) had appointed GD Apte & Co to carry out a forensic audit of Future Consumer, according to a disclosure made by the company to exchanges on May 23. Lenders of Future Consumer may ask them to resign as forensic auditor due to a conflict of interest.

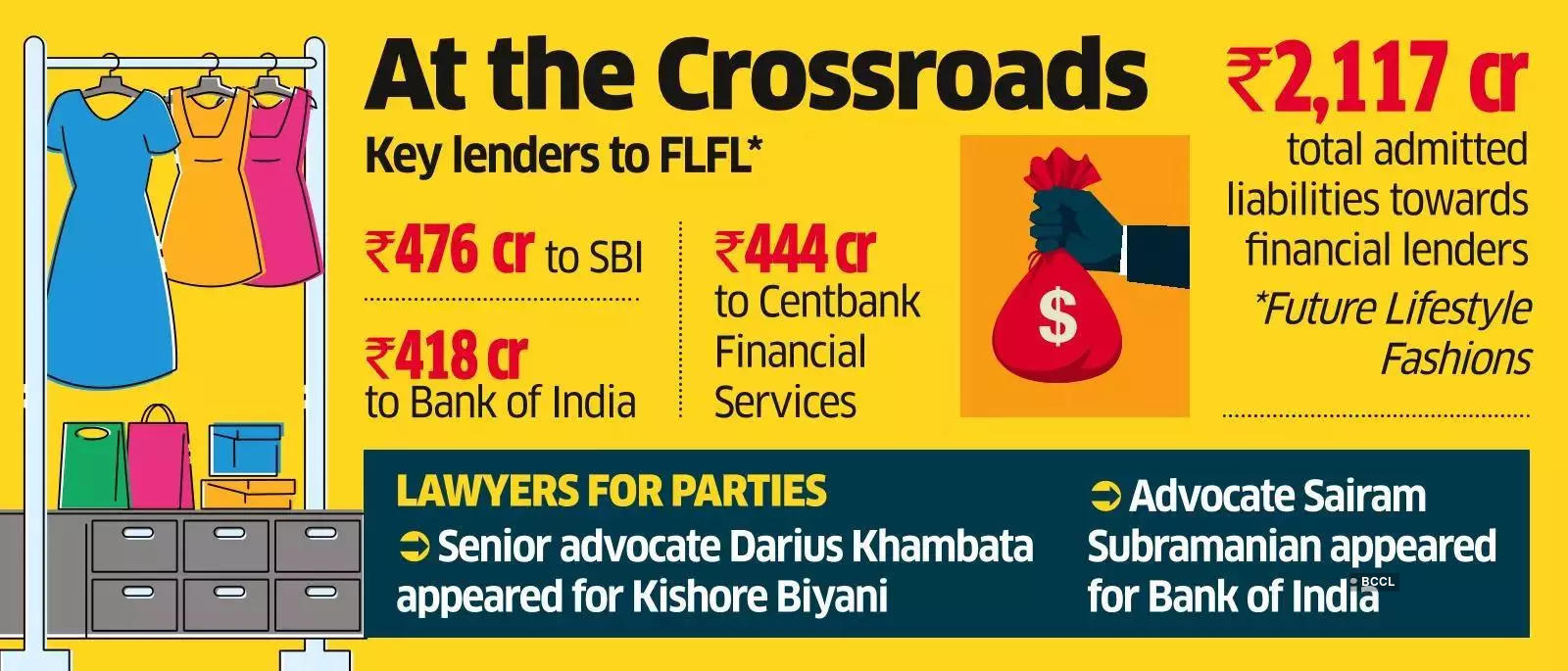

KPMG-backed resolution professional Ravi Sethia has admitted ₹2,117 crore claims from financial creditors against FLFL, according to disclosures made by the RP. The highest claim is from SBI at ₹467 crore.