Mumbai: From running shoes and joggers to dumbbells and yoga mats, sales of nearly half a dozen leading sports brands have sprinted in the past two years, during the pandemic and since. They have doubled business in India, driven by increasing awareness about fitness and surging demand for athleisure wear.

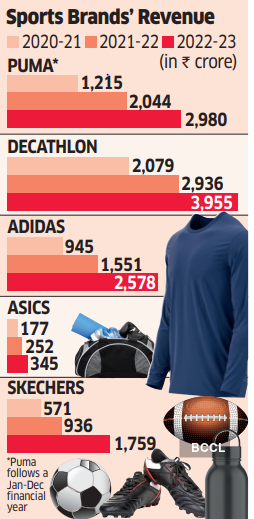

Brands such as Puma, Decathlon, Adidas, Skechers and Asics have all grown 35-60% year-on-year since FY21, posting combined revenues of ₹11,617 crore in FY23, according to regulatory filings sourced from the Registrar of Companies. Two years ago, these brands had sales of ₹5,022 crore put together. Demand for fitness wear and sports equipment for disciplines other than cricket grew as people prioritised health with the onset of Covid-19.

“The increased focus on health and fitness has resulted in individuals across ages looking for technical and performance footwear. Running is one of the fastest growing categories for us, along with a notable jump in search for walking shoes by adults aged over 45 years,” said Shreya Sachdev, head of marketing, Puma India. “Overall, the sports and athleisure category is growing faster than the average apparel and footwear market in the country.”

Companies said they have capitalised on the popularity of more casual styles in the wake of the pandemic, a trend that has subsided now although people are still more health conscious than ever.

“There is a clear trend of ‘casualisation’ and ‘sneakerisation’ and it is not just restricted during sports or leisure activities. We see people opting for casual attire even at offices, against the earlier assumption that post Covid, formal wear will be back in fashion,” said Abhishek Ganguly, former managing director at Puma India who recently started his own firm Agilitas Sports. “India is no longer just a cricketing nation as we see consumers increasingly getting involved in other activities such as running, football and gyms.”

With a population of 1.4 billion, India is one of the fastest growing and largest international markets for footwear companies.

Most global brands have been around for more than two decades in India and have grown by virtue of pushing their wares partnering cricket and other sporting activities. The newer entrants, however, have been positioning themselves as comfortable lifestyle and regular athletic wear brands.

“India is a crucial market for us and, with the changing consumer landscape, we see a huge potential with new and emerging demand for sports across different regions in India,” Asics Corp. CEO Yasuhito Hirota said in a statement last week, adding it will open 50 new stores in the country by 2025.