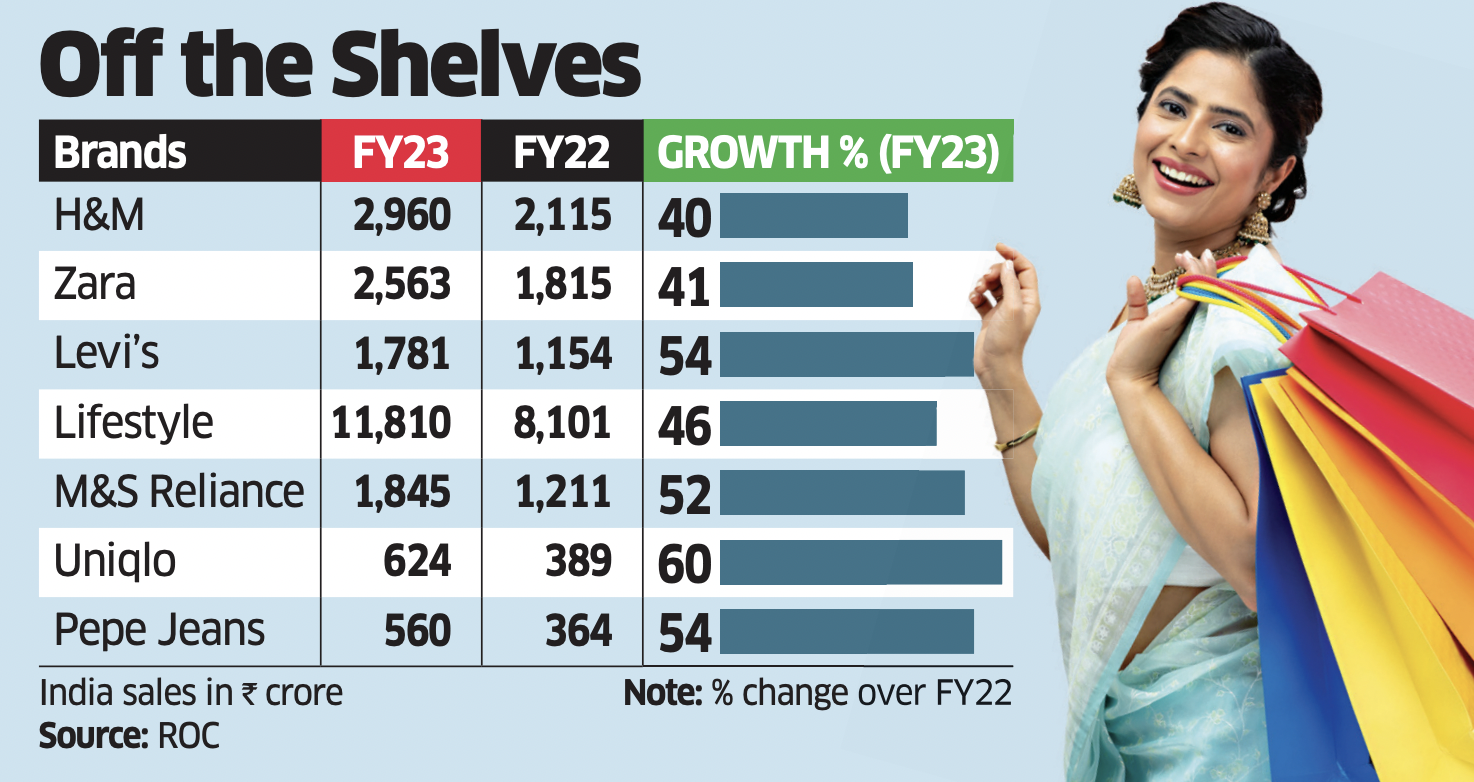

Top global apparel and fast fashion brands appear to have struck a strong chord with young customers, racking up sales growth of anywhere between 40% and 60% in FY23, bucking the trend in a market where the overall demand for discretionary products slowed down.

For instance, Swedish fashion retailer H&M and rival Zara reported a 40% increase in its topline while Japanese brand Uniqlo saw a 60% jump in sales. American denim maker Levi Strauss and British brand Marks & Spencer posted a 54% increase, latest filings with the Registrar of Companies showed. Dubai-based department store Lifestyle International, too, saw a 46% jump in revenues on a large base. These brands garnered combined annual revenues of nearly $2.6 billion, more than double compared to FY21 when it was $1.1 billion all put together.

“With consumers getting brand conscious, global brands have a natural advantage. There is a distinct aspirational momentum for international brands that carries them through. Also they can sustain having unsold inventory and discounting better than smaller peers,” said Devangshu Dutta, founder of Third Eyesight, a strategy consulting firm. “Also, these brands have not yet reached saturation point in terms of network and hence can invest further to widen their reach.”

The revenue surge was also led by brands’ shifting focus on ecommerce, which now accounts for more than a quarter of their sales, even as they face intensify competition from both local and global rivals in an increasingly crowded market where web-commerce firms continue to offer steep discounts. Over the past two years, sales growth for most retailers have been price-led, reversing the historic trend when volumes or actual demand drove a bulk of the sales.

The fashion retail segment has been struggling with a demand slowdown since January last year due to inflationary headwinds. The overall retail growth slowed down to 6% in both March and April, increasing marginally to 9% in August and September before falling slightly to 7% in October and November, according to the Retailers Association of India.

“Spends are shifting to experience, holidays and big ticket purchases such as cars. Stronger retailers which had the right product to price proposition works for consumers who are not necessarily looking at brands from global and local lens. What helped our sales was product rationalisation, renovation of stores as well as our value proposition,” said Manish Kapoor, managing director at Pepe Jeans that clocked 54% growth to Rs560 crore in FY23. “The current fiscal has been muted and we expect election spending and improved sentiment to drive recovery next fiscal.

As the world’s second most-populated country, India is an attractive market for aspirational apparel brands as rising disposable incomes cause the consuming base of the pyramid to broaden further. “The Indian economy is on course to be among the top economies in the world. The key factors driving the India consumption story include a large proportion of young population, rising urbanization, growing affluence, increasing discretionary spending and deeper penetration of digital,” said Levi Strauss in its latest annual report.

Last year Levi’s said India is now the largest market for them within Asia and sixth largest globally while M&S said it is opening a store every month in India, already its largest international market outside home in terms of store network.