Singapore’s Temasek and US’ Fidelity are in advanced discussions to invest around $200 million in Lenskart through a secondary share sale at a valuation of about $5 billion, three people aware of the matter said.

To put this in perspective, the round would take the homegrown eyewear company’s valuation to over three times that of Warby Parker, a New York-based online retailer for spectacles and contact lens. Warby Parker listed on the NYSE late in 2022 and has a market capitalisation of around $1.55 billion.

Lenskart’s secondary sale is taking place at an 11-12% higher valuation than its previous $4.5 billion, setting it apart from other such transactions that typically close at a lower valuation. “Temasek is leading the $200-million round by putting in $125-150 million,” said a person cited.

“Fidelity (brings in) the rest,” the person cited earlier said.

While sovereign wealth manager Temasek is an existing investor in Lenskart, investment fund Fidelity will be investing in the omnichannel retailer for the first time.

ET first reported on April 4 about a secondary deal being in the offing at the eyewear startup, even as a slew of late-stage internet companies prepare to close rounds of $100 million or more.

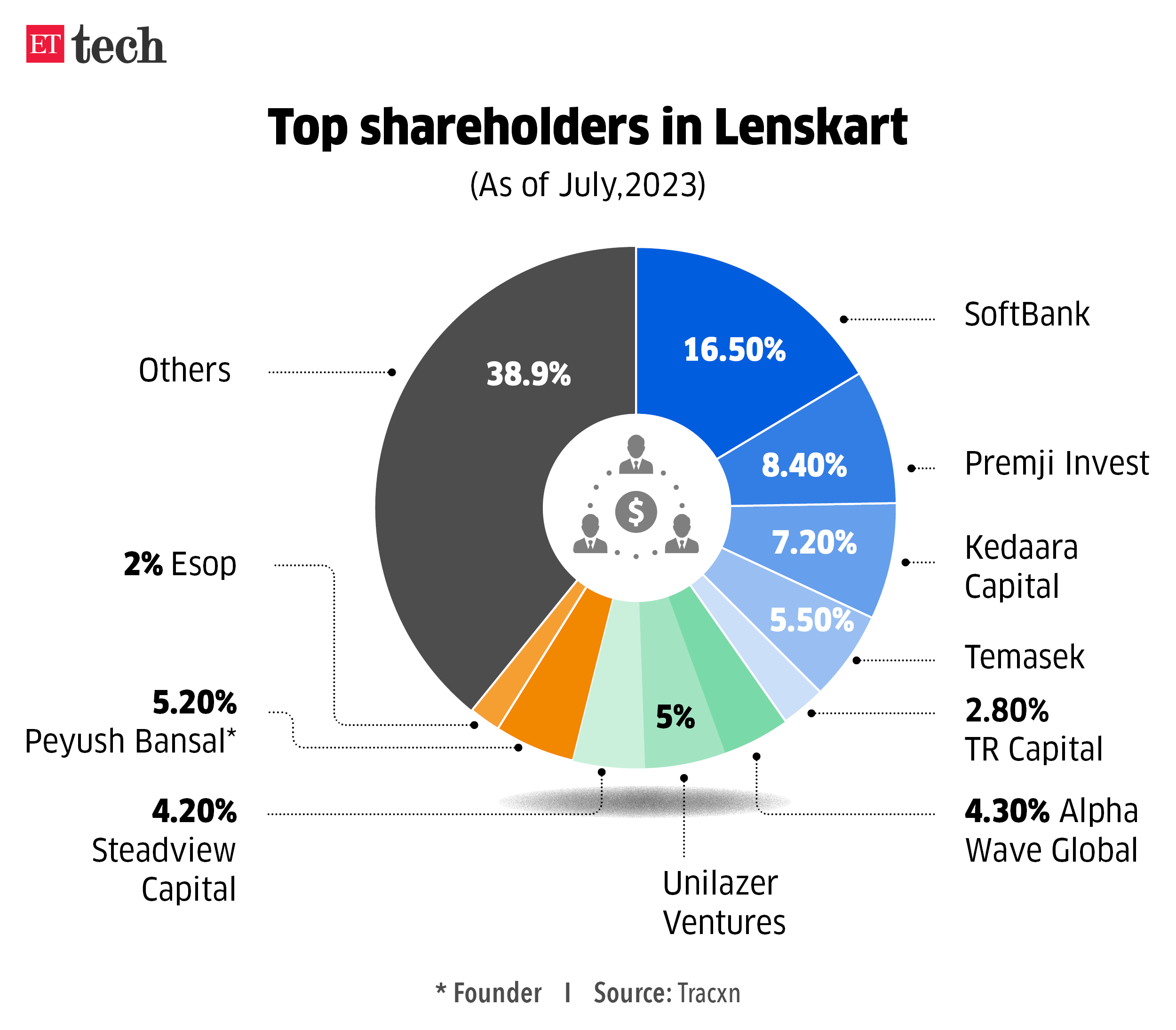

In the latest round, other early investors in Lenskart such as TR Capital, KKR and Avendus may also look to divest a portion of their holdings, people cited said. However, SoftBank — the largest institutional investor, with 16.5% — is not selling any stake in this round.

“It’s nearly done between these two investors,” another person aware of the talks said. Premji Invest, Kedaara Capital and Alpha Wave Global are among the other investors.

Lenskart chief executive Peyush Bansal and Fidelity did not respond to ET’s email query, while a spokesperson for Temasek declined to comment, citing policy.

Last year, Lenskart raised $600 million in total from Abu Dhabi Investment Authority and ChrysCapital, amid a widespread funding winter for new economy ventures. Of this, $450 million was in secondary share sale, which allowed existing investors such as SoftBank and Chiratae Ventures to partially sell their stake in the Gurgaon-based firm.

In a secondary share sale, money changes hands between investors and does not go to company coffers.

Fast & Sustainable

The big-ticket investor interest in Lenskart is part of a broader trend being seen in fast-growing companies with a clear path to profitability, which are often also notching up a significant premium on valuation.

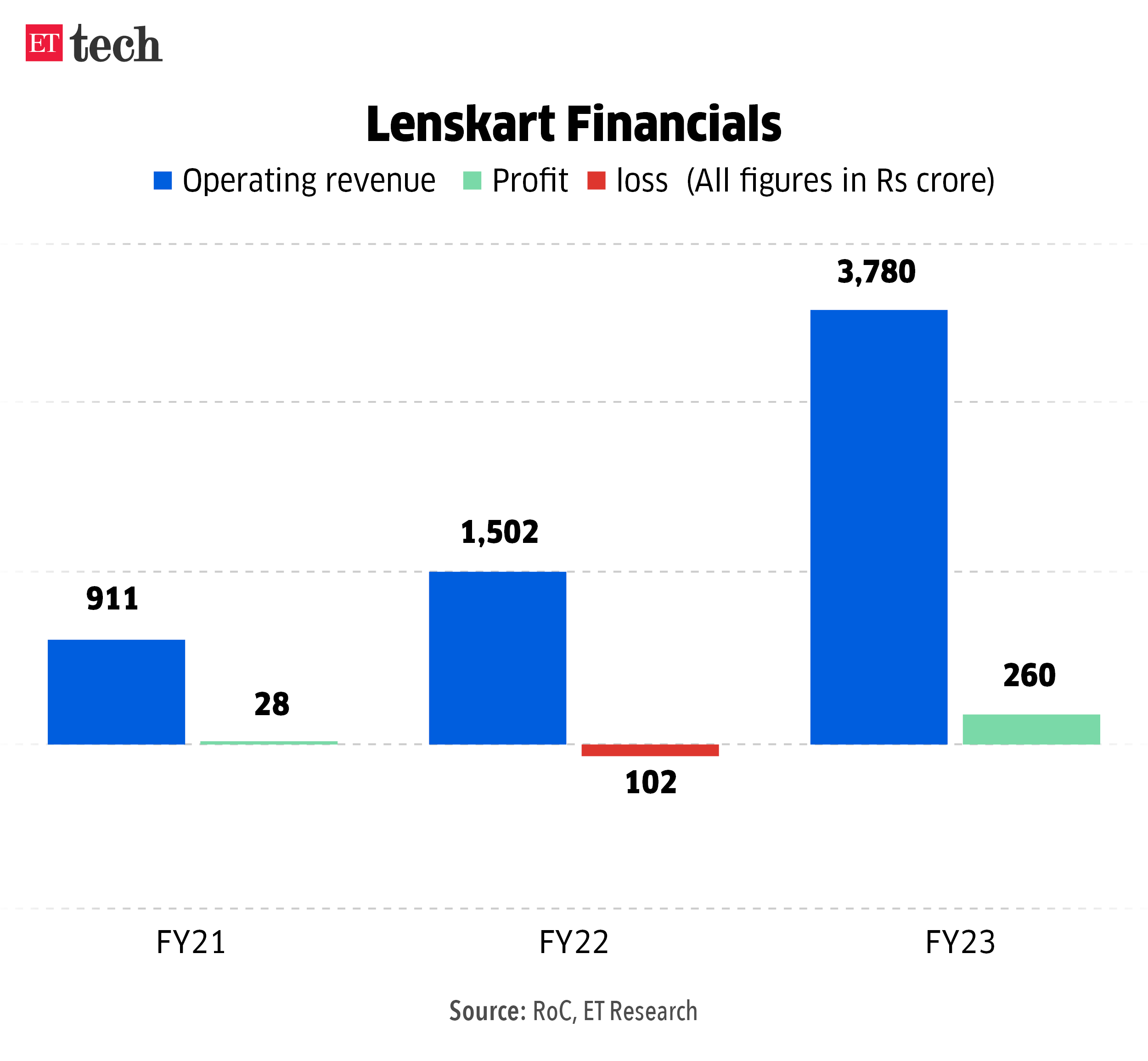

Lenskart is estimated to have closed FY24 with a revenue of Rs 5,500 crore. In FY23, it more than doubled revenue to Rs 3,780 crore while recording a profit of Rs 260 crore, compared to the loss of about Rs 100 crore in FY22. Lenskart is expected to maintain its profitability in FY24, but audited financials are yet to be filed with the Registrar of Companies.

The company operates around 1,500 retail outlets in the country, besides its own online platform. Lenskart made a major acquisition in 2022, Japan’s Owndays, as it sought to expand in Southeast Asia.

In September 2023, subsidiary Neso Brands invested $4 million for a “significant stake” in Paris-based omnichannel eyewear brand Le Petit Lunetier. Such an acquisition is typical of Neso and Lenskart is expected to retail such global brands in all its markets.

Recently, Bansal said in a LinkedIn post that he was looking for land near Bengaluru to build his new mega factory. Lenskart has opened its largest manufacturing facility in Rajasthan.

Founded in 2010, the startup has raised $1.7 billion in total, including secondary share sales, according to data from research firm Tracxn.

Busy Startup Street

After a funding freeze of around 18 months, healthy late-stage firms are back at the deal table.

ChrysCapital is finalising a secondary investment in HealthKart, a health supplements startup. Peak XV Partners is looking to divest stake in the Gurgaon-based firm through this transaction.

Quick commerce firm Zepto, mobility solutions companies Ather and Rapido, omnichannel beauty retailer Purplle, as well as ecommerce firm Meesho, are at various stages of closing big-ticket funding that will see primary and secondary share sales.

“We are also seeing a lot more interest now from investors, compared to six months ago. We are working on a new round, which will see a couple of early investors part-selling stake, but definitely there is momentum now,” a unicorn founder told ET.