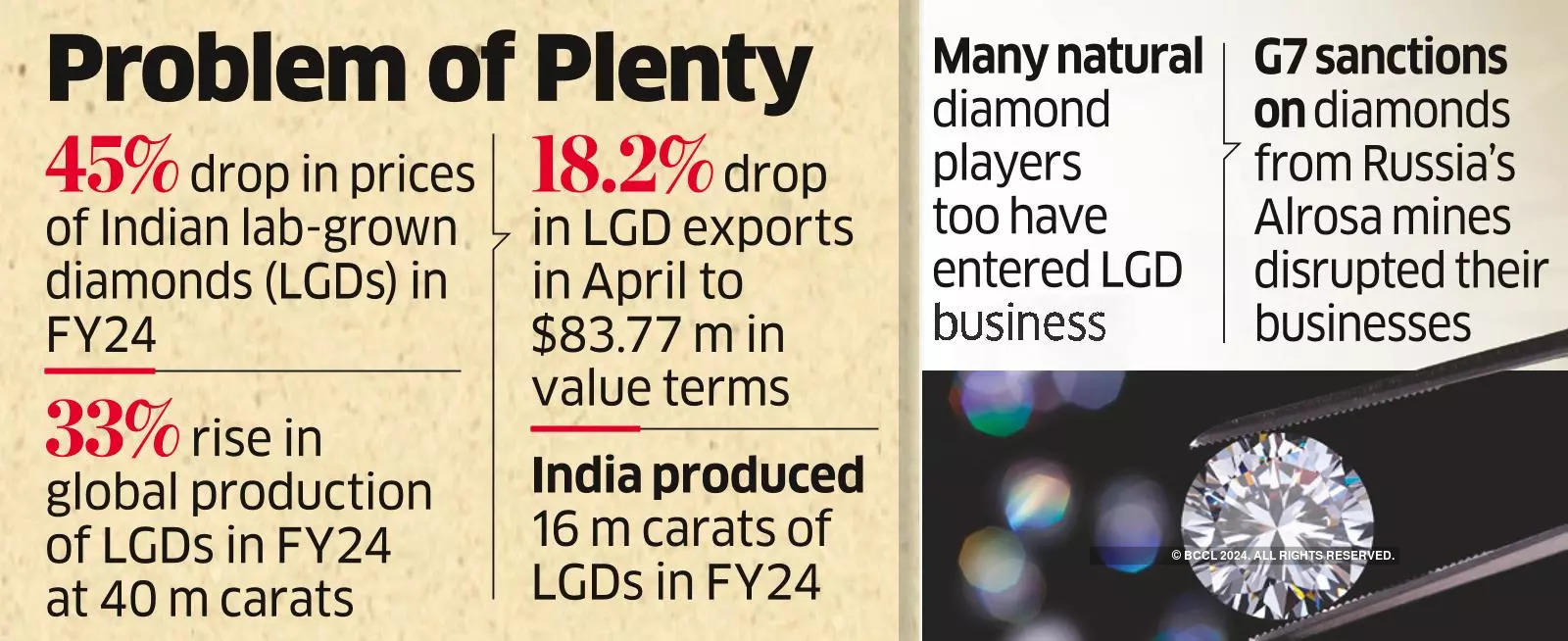

Prices of Indian lab-grown diamonds (LGDs) have crashed by 45% in FY24 due to overproduction in the global markets. In FY24 global production of lab-grown diamonds stood at 40 million carats, which is almost 33% higher than FY23 production.

Indian LGD exports have dropped by 18.2 % in April to $83.77 million in value terms compared to April FY23 as prices have fallen but demand at the home is increasing in tandem with rising gold prices prompting consumers to look at LGDs to bring down the overall cost of the jewellery. In FY24, India produced 16 million carats of LGDs.

“Prices have fallen by 45% in FY24. Any further decline in LGD prices will lead to severe losses for LGD manufacturers and will not be sustainable. The decline in LGD prices in FY24 simply erased supernormal profits and led to normalisation of profits across the value chain in the industry,” said Pooja Sheth Madhavan, managing director of Limelight Diamonds, a chain of lab-grown diamond stores. Limelight has 10 independent stores and 40 shop-in-shops across 25 cities and five stores are in the pipeline.

“This decline in prices has significantly increased the time required to repay the loan taken for purchasing LGD machines which in turn is creating a huge barrier for entrants in growing LGDs. This has led to quality and price control in the hands of credible growers,” Sheth Madhavan added.

Incidentally, many of the natural diamond players too have entered the LGD business as G7 sanctions on diamonds originating from Russia’s Alrosa mines disrupted their businesses. Also, the slowdown in natural diamonds exports to the US and China has prompted them to get into the LGD business and redeploy their existing workers in Surat in these units.

Trade sources say India now has 6,000 LGD reactors in the country. The number of companies engaged in creating LGDs is increasing and so are the reactors in the same proportion.

Tony Mehta, founder of Gogreen Diamonds said “The growing demand for LGDs in India and abroad has prompted me to change my business model. Now 85 per cent of my business constitutes LGDs and 15 per cent is natural diamonds. Demand for LGDs is growing at a fast pace in the US, UK, Australia, Canada, South America, and the Far East. India is a comparatively new market, but it is growing at a fast pace too as LGD is more affordable.”

While a carat of good quality natural diamond costs Rs 4-4.5 lakh, a similar quality LGD costs only Rs 35,000. And mined diamonds are becoming rarer as no new mines are coming up. Natural diamond prices, which was volatile in the first half of FY24, have stabilised since the November-December period.

Even Tanishq, the market leader in retail jewellery, is keeping a close watch on the growth of LGD sector in the country. Ajoy Chawla, CEO of Tanishq said “We are watching how the sector is shaping up in the country. Right now, we have no plans to enter the sector.”