Jewellery retailer Bluestone is negotiating an investment of about Rs 830 crore ($100 million) from Peak XV Partners, Steadview Capital and Think Investments, people aware of the matter said.

This pre-IPO (initial public offering) round will be a mix of share sale by early backers and fresh capital infusion that is expected to value the omnichannel retailer at around Rs 7,500 crore ($900 million) pre-money, they added.

Peak XV is investing about Rs 415 crore ($50 million), the people said. “Peak XV is in talks to lead the funding amid a wider inclination of venture funds to tap domestic brands and offline retailers,” said a person familiar with deal discussions.

ET reported on May 29 that Bluestone is stitching up a $100-million round and may join the unicorn club ahead of its planned public listing later this year.

Cash out

Peak XV has been backing retail brands such as Mokobara and Lyskraft of late.

The round “is a mix of primary and secondary transactions. Some family offices, through special purpose vehicles, may also join the round, which is expected to close in the next few days,” said a person aware of the matter.

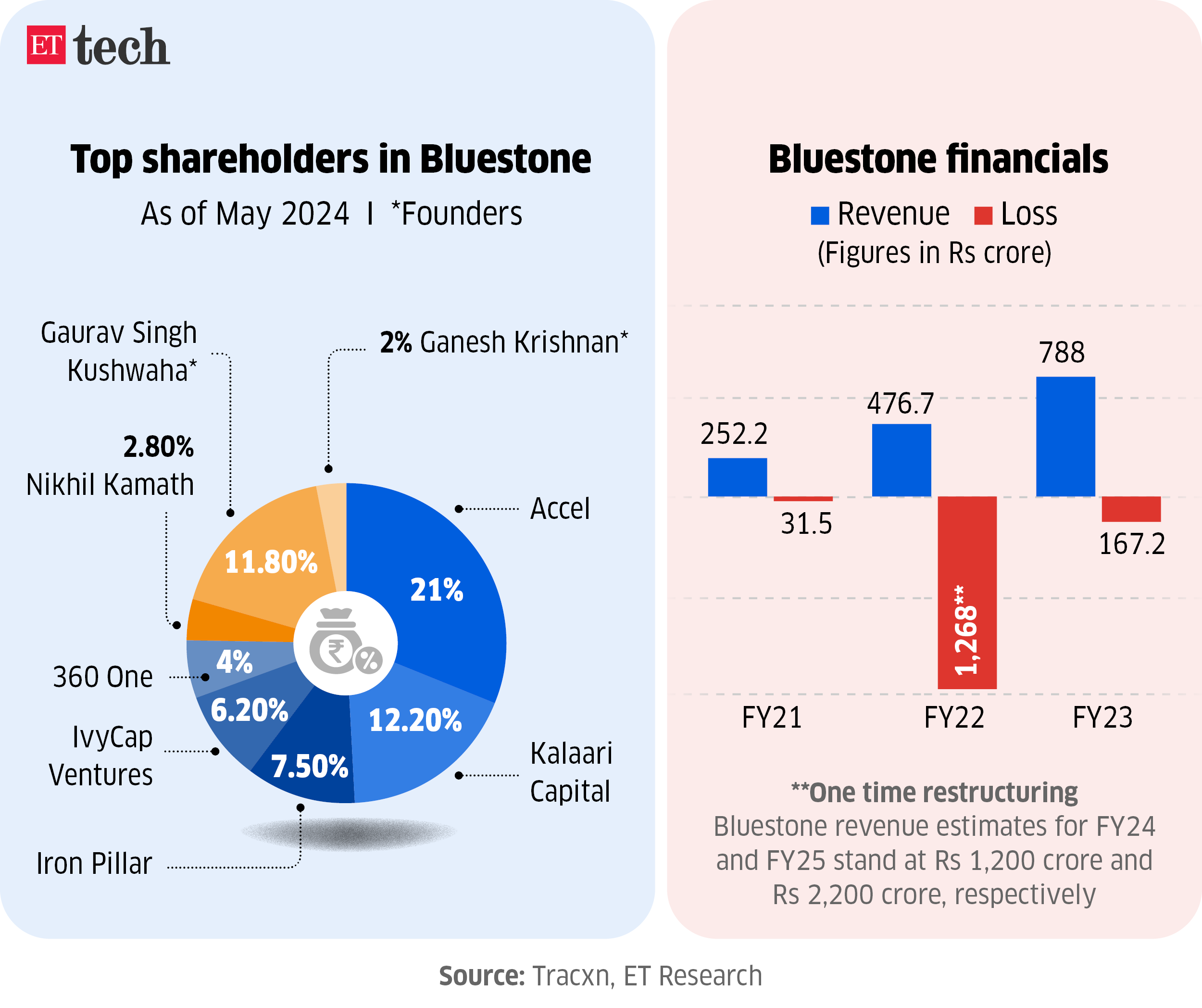

Accel and Kalaari Capital, the two early investors in Bluestone, own over 30% in the company. Others like Iron Pillar, Saama Capital, RB Investments, IvyCap and InfoEdge Ventures hold another 20% collectively. Founders Gaurav Singh Kushwaha and Ganesh Krishnan own nearly 14%.

The latest round values Bluestone at more than double its last funding — in September 2023 — when it raised capital from Manipal Group chief Ranjan Pai, Zomato founder Deepinder Goyal and Zerodha’s Nikhil Kamath, among others, at a $450-million valuation.

Emails sent to Steadview, Think Investments and Bluestone chief executive Kushwaha did not elicit any response till press time on Monday. Peak XV (formerly Sequoia Capital India) declined to comment.

VC wave

This latest deal underscores a rising trend of tech-first venture funds betting on various retail companies where new-age brands are challenging incumbents.

For Steadview and San Francisco-based Think Investments — both of which are multi-stage investment funds with bets across private and public companies — the IPO-bound Bluestone is a good fit.

Steadview’s India portfolio includes Ola, Lenskart and Urban Company, while the Shashin Shah-led Think has backed companies such as Swiggy, Dream11 and Star Health Insurance.

“Bluestone has built a reasonable offline retail business, which is now almost six times its online sales,” said an investor with knowledge of the company’s financials. “The unit economics of these stores is good. Bluestone has become a conventional jewellery retailer due to a higher share of diamond sales, which is better than an average gold retailer.”

The jewellery chain runs around 200 stores and plans to take them up to 500-600 over the next few years.

Resurgence

Bluestone, the second-largest omnichannel jewellery retailer after Titan’s CaratLane, has made a significant comeback after having been in the slow lane for many years. It is estimated to have closed FY24 with Rs 1,200 crore of revenue and Rs 3 crore ebitda, those aware of details said.

The Bengaluru-based company is forecasting Rs 2,200 crore revenue for FY25, as per internal targets.

The interest in Bluestone’s pre-IPO round, as well as the eventual listing, is encouraged significantly by the Tata’s CaratLane deal — where Titan bought out the founder’s (Mithun Sacheti) stake last year, valuing the firm at Rs 17,000 crore.

Founded in 2011, Bluestone reported Rs 788 crore in operating revenue for FY23, up from Rs 477 crore a year earlier, even as its losses reduced to Rs 167 crore, from Rs 1,268 crore. The steep loss in FY22 was due to an accounting change. In FY22, it grew nearly 90% after a flat year of growth in FY21.

Premji Invest-backed Giva, which sells silver jewellery, and Melorra are among other prominent startups in the space.

ET reported on February 15 that the Accel-backed Bluestone is planning for a Rs 2,000 crore IPO this year and has started engaging with merchant bankers. Kushwaha has been engaging with private and public market investors over the past several weeks.