Market impact

LVMH reported a significant slowdown in sales growth, with the fashion and leather goods unit, its largest division, showing a mere 1% increase in organic revenue last quarter.This is a sharp contrast to the 21% growth seen a year earlier, resulting in a 5.2% drop in LVMH’s shares, erasing a substantial portion of its market value.

China, a crucial market for luxury goods, experienced a 14% decline in sales for LVMH in the last quarter. While Chinese travelers boosted sales abroad, particularly in Japan due to the weak yen, domestic demand remained weak. This shift has pressured LVMH’s profit margins as Chinese consumers increasingly purchase luxury items overseas to take advantage of favorable exchange rates.

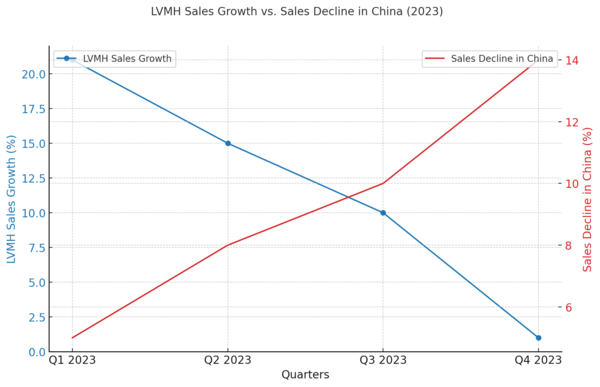

The graph above illustrates the trends in LVMH’s sales growth versus the decline in sales in China throughout 2023. The blue line represents the percentage growth in LVMH’s overall sales, while the red line shows the percentage decline in sales within the Chinese market.

Key observations

LVMH’s sales growth experienced a significant drop from 21% in Q1 to just 1% in Q4.

The decline in sales within China progressively worsened, reaching a 14% decline by Q4.

These trends highlight the broader challenges faced by the luxury market, influenced significantly by economic slowdowns and changing consumer behaviors in key markets like China.

Causes of the downturn

Here are several factors which contribute to the slump in the luxury market:

Economic and geopolitical uncertainty: Global economic instability and geopolitical tensions are dampening consumer confidence and spending power.

China’s economic slowdown: As one of the largest consumers of luxury goods, any economic downturn in China significantly impacts global luxury brands. Changing consumer behavior and increased overseas spending further complicate the retail landscape.

How the Ambanis put Indian fashion on the global map

Isha Ambani: The new fashion baroness

Pandemic-era spending boom receding: The luxury sector enjoyed a surge in spending during the pandemic as affluent consumers diverted funds from travel to high-end goods. This boom has now plateaued, and the market is adjusting to a post-pandemic normal.

Inflation and market dynamics: Inflationary pressures, particularly in the United States, have reduced consumer spending on non-essential luxury items. Other luxury brands have also reported significant declines in profit and sales, citing reduced demand from China and the US.

Consequences for the luxury market

The slump in luxury spending has several implications:

Stock market reactions: Luxury brands like LVMH have seen significant drops in their stock prices, affecting their market valuations and investor confidence.

Shift in consumer behaviour: Consumers are increasingly purchasing luxury goods during overseas trips to take advantage of weaker foreign currencies. This trend affects domestic sales and pressures profit margins for brands relying on in-country purchases.

Performance disparity among brands: While some luxury brands have weathered the downturn better, others have reported stagnant or declining sales, highlighting varying resilience within the sector.

Operational adjustments: Companies are reassessing their operational strategies, focusing on efficiency and cost management to maintain profitability.

Market outlook and strategy: The luxury market is likely to see a more cautious approach to expansion and investment, with brands prioritizing strengthening their presence in resilient markets and innovating to attract and retain consumers in volatile regions.

Global economic turbulence has significantly impacted luxury giants like Gucci, part of the Kering Group, and Burberry. Both brands have reported slower sales growth, particularly in regions that were previously robust. Gucci, for instance, has seen a decline in consumer demand in North America and Europe, markets that have traditionally been strong. Similarly, Burberry has struggled with reduced sales in China, a market that has been pivotal to its growth strategy. These brands are now reevaluating their market approaches, focusing on sustainability and digital transformation to attract a more cautious and value-driven consumer base.

The effects of the economic slump are also felt by Swiss watchmakers like Rolex and Patek Philippe, known for their ultra-luxury timepieces. The high price points of these watches make them particularly sensitive to economic fluctuations. As disposable incomes shrink and consumers prioritize essential spending, the demand for such luxury items has waned. These brands are adapting by emphasizing limited editions and exclusive collections to maintain their allure and justify their premium pricing in a challenging market environment.

The automotive segment of the luxury market is also experiencing a noticeable downturn. Brands like Rolls-Royce and Bentley, which cater to the ultra-wealthy, are witnessing a drop in sales as economic uncertainties prompt even affluent buyers to delay or reconsider major purchases. The slowdown in China, one of the largest markets for luxury cars, has particularly impacted these brands. To counteract this, luxury automakers are diversifying their portfolios with electric and hybrid models, aiming to attract environmentally conscious consumers and adapt to the evolving market dynamics.

Coming back to the fashion sector, brands such as Chanel and Prada are feeling the effects of the global luxury market slump. Both brands have reported slower sales growth and are facing increased competition from emerging luxury brands that appeal to younger, more price-sensitive consumers. The pandemic-induced boom in luxury goods spending has tapered off, leading to a more competitive and challenging market environment. To stay relevant, these brands are investing in innovative marketing strategies, expanding their digital presence, and enhancing customer experiences both online and offline. This strategic pivot is essential for navigating the current slump and securing long-term growth in an increasingly volatile market.

The luxury market is facing a challenging period characterized by reduced spending, economic uncertainties, and shifting consumer behaviors. The data from leading luxury brands highlights the severity of the downturn, particularly due to the economic slowdown in China. The consequences of this slump are far-reaching, impacting stock valuations, operational strategies, and market dynamics. Moving forward, luxury brands will need to adapt to this new landscape, focusing on innovation, efficiency, and strategic market positioning to weather the storm and emerge stronger.