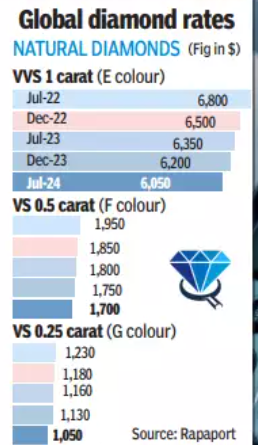

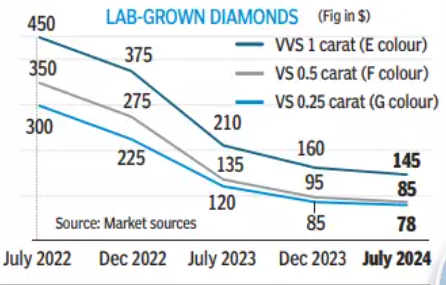

The lab-grown diamond market has seen a significant drop in prices, from $300 a carat in July 2022 to $78 a carat recently. Natural diamonds experienced a 25-30% price drop too. Factors like rising gold prices, a downturn in the US economy, and changes in Chinese buying patterns have impacted the diamond industry negatively, reported The Times of India.

As a result, diamantaires and businesses of varying sizes in Surat, where the diamond industry is a major employer, face challenging times.

“From 38,000 workers employed in Surat to small/medium businesses and large enterprises, everyone has been hit,” Ashok Gajera, Chairman and Managing Director of Laxmi Diamonds, told ToI.

Diamond stock devaluation is pressuring enterprises to fulfill orders at a loss.

Ashok Gajera stated, “Diamond rates have been falling for the past 22 months.”

The beginning of 2023 saw an increase in rough diamond imports to India, giving industry stakeholders hope for recovery. Unfortunately, this optimism did not last as the market now faces an oversupply issue. Gajera commented on the situation, noting that rough diamond imports rose in February this year, but the positive outlook was short-lived, and the oversupply issue persists.

Additionally, the demand for flawed natural diamonds has waned, with fierce competition from flawless lab-grown diamonds. “China, which used to be a large buyer of flawless mined stones, is suddenly not interested and its purchasing power is merely 10%-15% of what it was,” explained Gajera.

The import-demand mismatch

- Imports quickly returned to pre-moratorium levels by early 2024, but polished diamond exports performed poorly.

- This suggests that the country brought in more rough diamonds than were needed.

- According to Rapaport, the volume of rough diamond imports increased by 5% to 57.7 million carats in the first five months of 2023-24.

- However, in terms of value, there was a 3% year-on-year decline, totaling $6.54 billion.

- This occurred despite a 21% year-on-year drop in polished diamond exports, which amounted to $6.66 billion.

- The volume of polished exports also decreased by 15%, reaching 8.1 million carats.

Data from the Indian gems and jewellery sector indicates that overall gross exports of gems and jewellery during April-May amounted to $4,691.6 million (Rs 39,123 crore), reflecting a 5.9% decrease from the previous year. Declines were notable in the cut and polished diamonds sector, with exports falling 15.5% to $2,627 million. Similarly, the provisional gross export of polished lab-grown diamonds dropped 15.5% to $204.2 million from $241.6 million in the same period last year.The sector recognized the government’s effort to reduce import duty from 15% to 6% in Budget 2024. However, Kanaya Kakad, director of India Bullion and Jewellery Association’s governing board, expressed concerns for traders.

“Traders who hold stocks of gold will suffer losses in the short term – they had purchased at a higher rate but will now have to sell cheap,” Kakad told ToI.

Sabyasachi Ray, executive director of the Gem and Jewellery Export Promotion Council (GJEPC), highlighted the broader social and economic impact of the industry’s downturn. He stressed that the industry is not solely composed of wealthy individuals but includes millions of craftsmen and blue-collar workers.

“We have been told ours is a sector of rich people. But that isn’t so. There is a front-end and there is a back-end. The back-end comprises millions of karigars (craftsmen) and blue-collar workers,” Ray told ToI.

“The gems and jewellery industry employs 5 million people, many of whom hail from marginal sections. These karigars are there everywhere – Mumbai, Satara, Sangli, Kolhapur, Gujarat. Imagine the scale of employment nationwide if 50,000 people work in Bharat Diamond Bourse in BKC and one lakh in SEEPZ. It is such a labour-intensive sector that anything the govt does will impact five million workers,” Ray added.

Overall, the gems and jewellery sector faces significant challenges, from fluctuating diamond and gold prices to reduced buyer interest in key markets such as China. The industry’s future remains uncertain as stakeholders navigate these tough times.