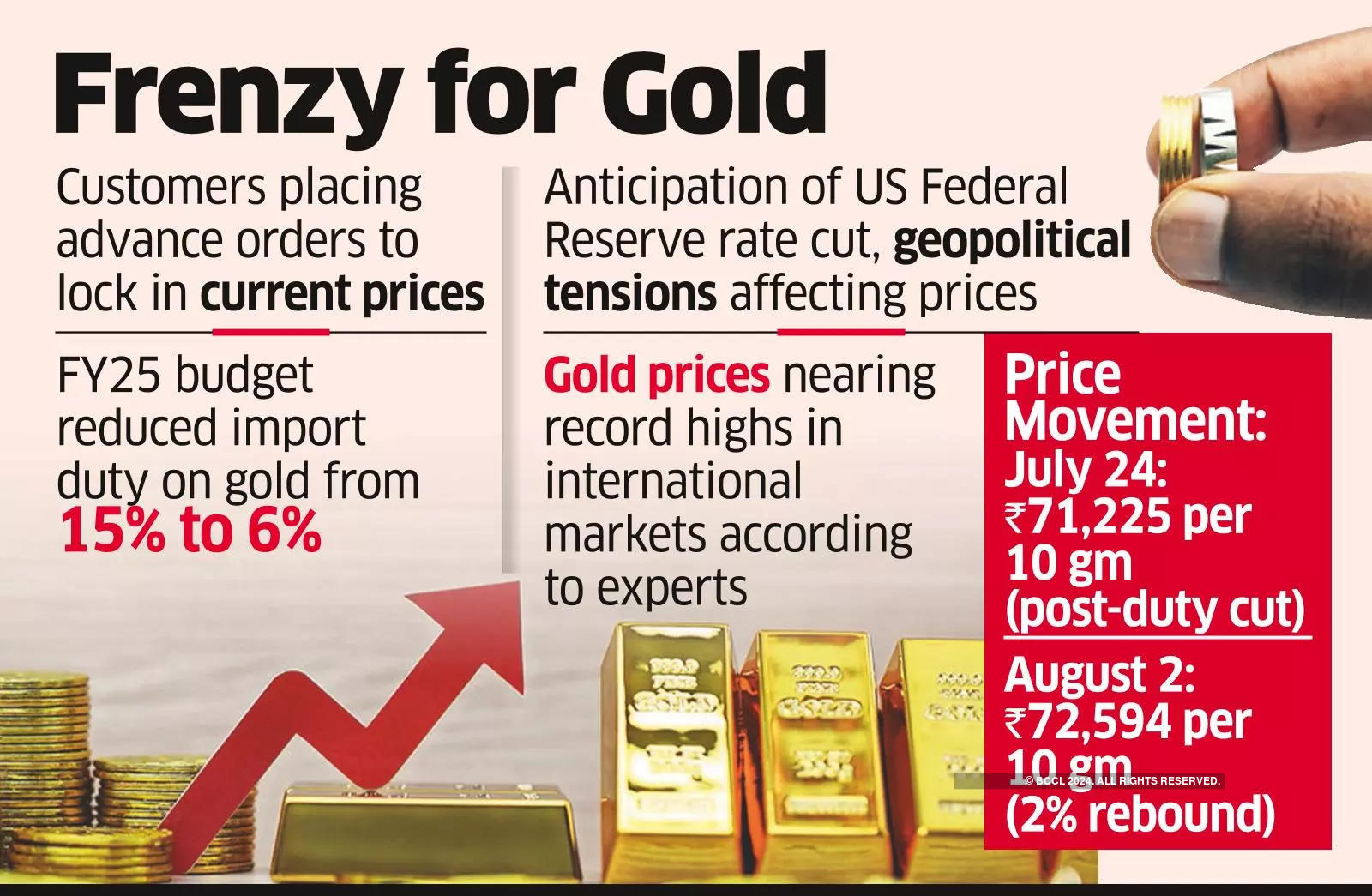

Consumers are rushing to buy gold, some even placing advance orders, on fears that prices may start rallying again after a recent decline, said jewellers and trade executives. Prices of the yellow metal fell after a customs duty cut in the budget but have since rebounded amid a rush of buyers in the world’s second-largest bullion market.

Jewellers reported up to 15% higher footfalls in the first weekend of August compared to the previous weekend, as consumers sought to benefit from the lower prices. However, the demand surge led to prices rebounding by 2% within a fortnight of the duty cut following expectations of a rate cut by the US Federal Reserve and flaring up of the West Asia conflict.

The FY25 budget, presented on July 23, lowered the import duty on gold to 6% from 15%, bringing cheers to consumers. On July 24, the day after the duty cut, retail prices of gold stood at ₹71,225 per 10 gm, which has risen to ₹72,594 per 10 gm as of August 2.

“The feeling among the customers is that prices might further go up as the geopolitical tension might further escalate as Iran has threatened to attack Israel. This is prompting them to make purchases. They are buying jewellery ranging between ₹25,000 – ₹4 lakh,” said Colin Shah, managing director at Mumbai-based Kama Jewelry.