MUMBAI: Neeraj Chopra dazzled all with a breathtaking javelin throw, clinching a silver medal. Meanwhile, Manu Bhaker, Sarabjot Singh, Swapnil Kusale, Aman Sehrawat, and the relentless Indian hockey team brought home bronze and captured our hearts with their indomitable spirit. These athletes will undoubtedly be showered with cash, gifts, and rewards, whether from govt or passionate industrialists offering cars, houses, or other perks.And where there’s income, taxes aren’t far behind.

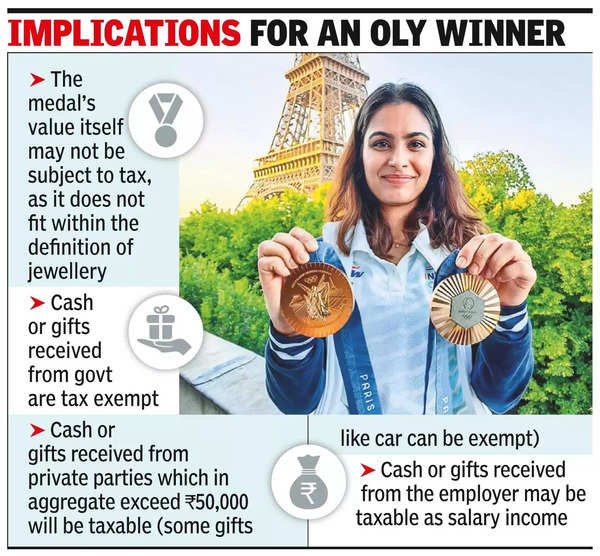

Cash or rewards from govt: Media reports suggest that French medalists will receive Rs 80,000 for gold, Rs 40,000 for silver, and R s20,000 for bronze from their govt – but tax will be withheld. In contrast, Indian athletes enjoy a better deal, as cash or gifts from govt are tax-free.

Central Board of Direct Taxes (CBDT) clarified in a 2014 notification that rewards from the central or state govts to Olympics, Commonwealth, or Asian Games medalists are exempt under Section 10 (17A) of Income-Tax (I-T) Act.

Manu Bhaker, who won two medals at Paris Olympics, and Sarabjot Singh were awarded Rs 30 lakh and Rs 22.5 lakh, respectively, under the reward scheme of ministry of youth affairs and sports – these are likely to be tax free. Indian hockey team’s rewards from Punjab and Odisha state govts will be tax exempt too.

In 2018, the Income Tax Appellate Tribunal ruled that Rs 96 crore awarded in aggregate to shooter Abhinav Bindra, India’s first individual Olympics gold medalist, was tax exempt as the awards were from govt.

Is value of the medal taxable?

Until recently, the US taxed all its medal winners on value of their medals in addition to rewards.

However, since 2016, owing to Appreciation for Olympians and Paralympians Act, athletes are only taxed on these if their annual income exceeds $1 million. India’s tax laws don’t explicitly address the taxation of sports medals, and the judiciary hasn’t tackled the issue either.

Gautam Nayak, tax partner at CNK & Associates, notes that the key question is whether a medal constitutes jewellery. He argues it doesn’t, as it’s not a daily wearable item like a gold chain or necklace. Section 56(2)(x) of I-T Act states that movable property (as defined and specified) without consideration where aggregate value exceeds Rs 50,000 is taxable. For determining “specified goods” one turns to the definition, which covers land, buildings, shares, securities, and jewellery – a medal would not fall in any such category, Nayak says.

Cash or gifts received from private parties (including employer): “Under I-T Act, gifts received in excess of Rs 50,000 (in aggregate) are taxable under the head ‘Income from Other Sources’ – value of a gift-in-kind would need to be declared as income and would be taxable at the applicable I-T slab rates,” says Amarpal Singh-Chadha, tax partner and India mobility leader at EY-India. Some industrialists in order to encourage sports, do give away gifts in kind – say a flat or a car. As Nayak explains, going by the definition explained earlier a gift of a car may escape tax.

Some employers give gifts be it in cash or kind to employees who won a medal. Singh-Chadha adds, “Any gift provided by an employer is considered as a perquisite (where the value exceeds Rs 5,000). It is added to the employee’s salary and the employee pays tax at the applicable slab rate against his taxable income. The employer is also responsible for deducting tax at source (TDS) accordingly.”

According to Nayak an alternative view could be that the gift was in appreciation of the employee’s performance at the games and not related to his employment. Thus, it would not be taxable as salary – but as income from other sources. In this context, as explained earlier, some gifts in kind could escape tax if they fall outside the specified definition.

International tax comes into play: “If an Olympics medalist earns sponsorship income in France during the Paris Olympics 2024, the implications under India-France tax treaty would have to be analysed. Such income earned in France will be subject to tax in France as per its local tax laws and relief for double taxation, if any, can be claimed by the sportsperson,” says Singh-Chadha.