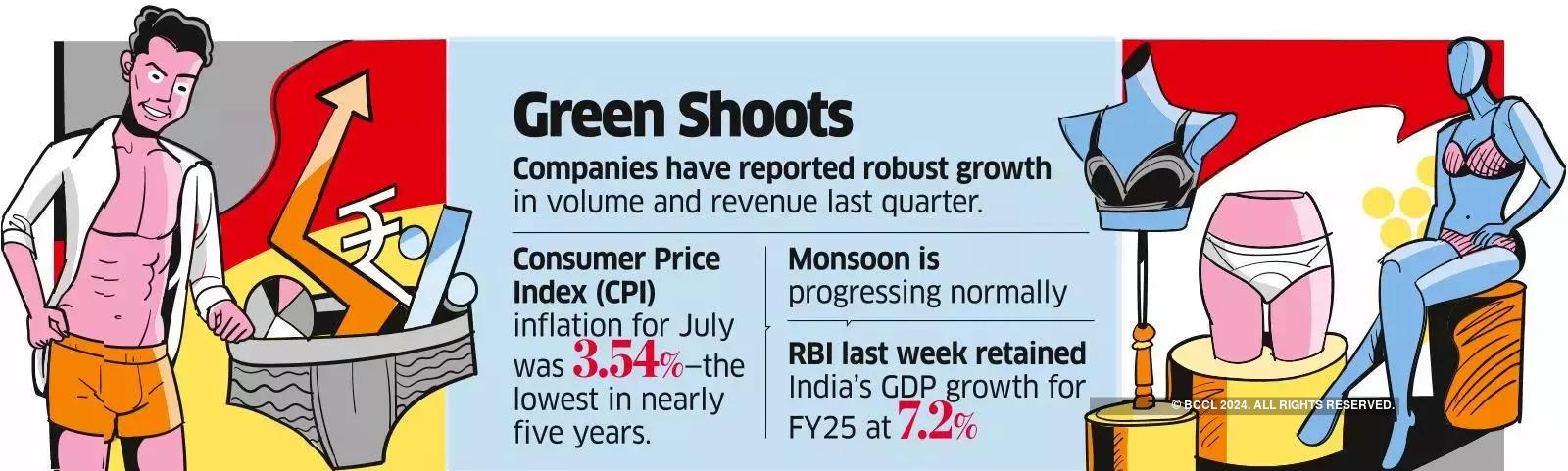

Amid positive indicators for the economy such as slowing inflation and progress of the southwest monsoon, here’s another that reflects optimism: inner wear sales.

Leading companies such as Page Industries, which has the rights for the Jockey brand in India, Aditya Birla Fashion and Retail, Arvind Fashions and Rupa & Co. have attested to this in earnings calls this month. A consumption recovery of inner wear, including men’s underwear, is in sight with green shoots visible in the June quarter. Sentiment has also been boosted by sales kicking off through quick commerce.

The so-called men’s underwear index, thought up by former US Federal Reserve chairman Alan Greenspan, is said to detect the beginning of a recovery during tough times, marking a turnaround from a slump in consumption. When money is tight, people, especially men, tend to put purchases of these essential garments off as long as they can – that’s the theory.

Page Industries management told investors that sales have been lifted with better footfalls thanks to a revival in demand as well as action to improve inventory health at distribution hubs and ensuring new launches are available in stores. Managing director Ganesh VS cited early positive indicators.

In its June quarter earnings release, Page said consumer confidence is rebounding and leading to increased spending on clothing and accessories.

“The rise of ecommerce and digital platforms has expanded market reach, enabling brands to connect with the consumers more effectively,” it said. “The industry is poised for significant growth.”

Inner wear sales have been particularly impacted for over six quarters now, along with a slowdown in overall apparel demand. Primary sales, or despatches from companies to dealers, for the industry were stagnant for the last few quarters due to high unsold stock since Covid. Primary sales by volume, or number of units sold, grew last quarter, though at a slower pace than secondary sales.

For Arvind Fashions, the inner wear category is growing at double digits, faster than overall sales at the company. Rupa said revenue grew 8% in the April-June period while volume growth was 9% “supported by strong sales in the economy.” Lux Industries too reported a 9% jump in volume and revenue last quarter.

VIP Clothing, which sells brands such as VIP and Frenchie, said there were “signs of recovery and growth in the market.” The company said in its management guidance that revenue is expected to grow 15-20% in the September quarter “owing to good visibility of product offtake.”

Aditya Birla Fashion and Retail’s management said while the inner wear business posted growth last quarter, the athleisure segment continues to shrink due to the high base of the Covid period when multiple new brands had entered the segment due to a sudden surge in demand. However, managing director Ashish Dikshit said, even for athleisure, the worst is behind with the base stabilising.

Apart from the men’s underwear index, other macro indicators are also pointing toward a recovery. Inflation based on the Consumer Price Index (CPI) for July was 3.54%, the lowest in nearly five years, although this was accentuated by the base effect. The monsoon is progressing normally, while the Reserve Bank of India last week maintained the Indian economy will grow at 7.2% in FY25.

“Domestic economic activity continues to be resilient,” RBI governor Shaktikanta Das said last week. “On the supply side, steady progress in southwest monsoon, higher cumulative kharif sowing and improving reservoir levels augur very well for kharif output. Manufacturing activity continues to gain ground on the back of improving domestic demand.”