MUMBAI: Markets regulator Sebi is expected to take steps to rein in the retail frenzy in F&O trading in a board meeting on Sept 30. These decisions could include tightening of rules for the speculative futures & options segment of the market and stricter margining system, sources said.

The Sebi board is also expected to give its nod for a ‘new asset class‘ that was proposed by the regulator in July.It will serve as an investment product for rich investors that would be a hybrid product combining features of mutual fund plans and portfolio management schemes.

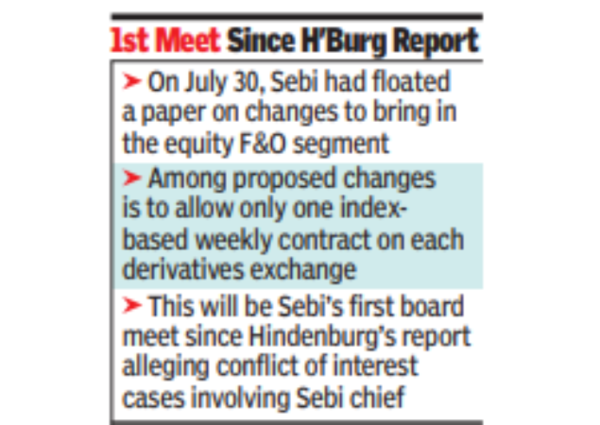

This will be Sebi’s first board meeting since US-based short-seller Hindenburg came out with a report on Aug 11, alleging conflict of interest cases involving Sebi chief Madhabi Puri Buch and husband Dhaval Buch. Both have denied all allegations.

The board may also allow a new set of regulations that’s aimed at passive-only fund houses since these tech-driven entities do not need to adhere to every stringent norm applicable to actively managed mutual funds.

On July 30, Sebi had floated a consultation paper on some changes that the regulator wanted to bring in in the equity F&O segment. Last month, Sebi chief had said it had received more than 6,000 comments on the same. Among the changes Sebi had proposed is to allow only one index-based weekly contract on each derivatives exchange. The rule could rein in unabated speculative trading in the F&O segment but at the same time could be a drag on the turnover, revenue and hence profits of the exchanges that run these segments, top bourse officials had said.

Speculative trading in the F&O segment has reached a level where, during the three-year period ending March 2024, only 7 out of 100 retail traders had made money, a recent Sebi study showed. Retail traders as a group lost a combined Rs 1.8 lakh crore during the study period, that is FY22 to FY24.