In a landmark judgment, Supreme Court ruled in favour of the income-tax (I-T) department, upholding the validity of nearly 90,000 reassessment notices issued after April 1, 2021, under the old provisions. Over 9,000 writ petitions had been filed in various high courts challenging these notices, with most courts siding with taxpayers.

A bench of Chief Justice of India D Y Chandrachud and Justices J B Pardiwala and Manoj Misra responded to 727 I-T appeals.

These reassessment notices cover assessment years from 2013-14 to 2017-18, involving both individuals and corporations. The estimated quantum involved could run into thousands of crores.

The SC had to determine whether I-T can re-open assessments after April 1, 2021, as per the pre-amended provisions of the I-T Act.

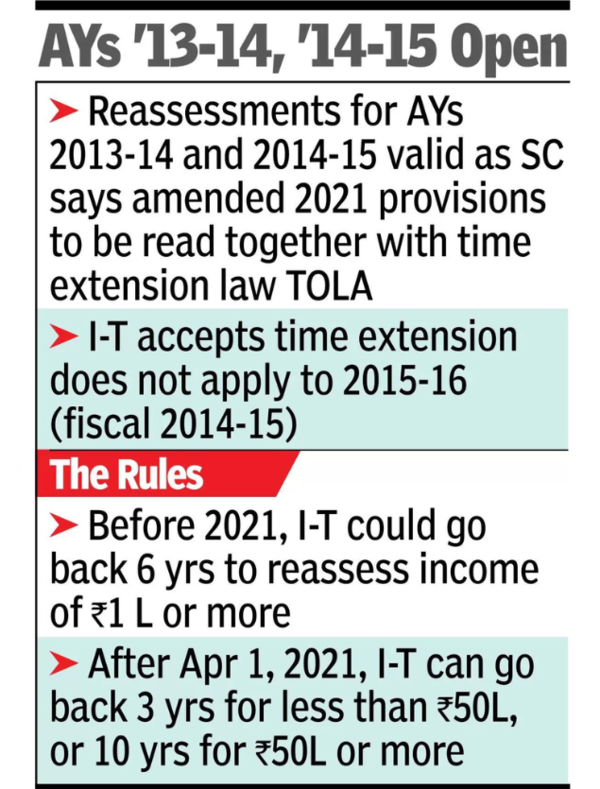

According to the provisions of the I-T Act prior to April 1, 2021, cases could be reopened for reassessment up to six years before the relevant assessment year (in which the notice was received) if the escaped income was Rs 1 lakh or more.

The 2021 amendment changed the timeline and the I-T authorities could re-open matters going back up to three years, if the escaped income was less than Rs 50 lakh. If the quantum was higher, the department could go back up to 10 years.

More important, the 2021 amendment inserted a new provision (Section 148A) which mandated the department should send a preliminary (showcause) notice before sending a reassessment notice. This gave the taxpayer the right to be heard and the I-T officer was duty-bound to consider the submissions made.

However, in view of the COVID-19 pandemic, the government issued a notification to extend the time period for issuance of notices under the old law. Consequently, reassessment notices were issued between April 1, 2021, and June 30, 2021, as per the provisions of the old law.

In technical terms, the SC had to determine whether the benefit of ‘Taxation and Other Laws (Relaxation and Amendment of Certain Provisions Act)’ – the TOLA Act, which enables relaxation of time limits under specific acts would govern the timeframe for reassessment. The moot issue was: would the executive powers – aka the notification prevail despite a new legislation (new provisions)?

Several high courts, such as Bombay HC, Gujarat HC, Allahabad HC quashed all the reassessment notices on various grounds. Their main contention was the new provisions were more beneficial and were meant to protect the rights and interests of taxpayers. These high courts had held TOLA would not extend the time limit for issuing reassessment notices.

Deepak Joshi, advocate, said: “The I-T department has conceded the time extension under TOLA does not apply to the assessment year 2015-16 (financial year 2014-15). Thus, proceedings for this particular financial year will be invalid as being time barred.”

“However, reassessments for AYs 2013-14 and 2014-15, which would otherwise be time barred under the new provisions will be valid, as the SC has said that the amended provisions are to be read together with TOLA,” added Joshi.