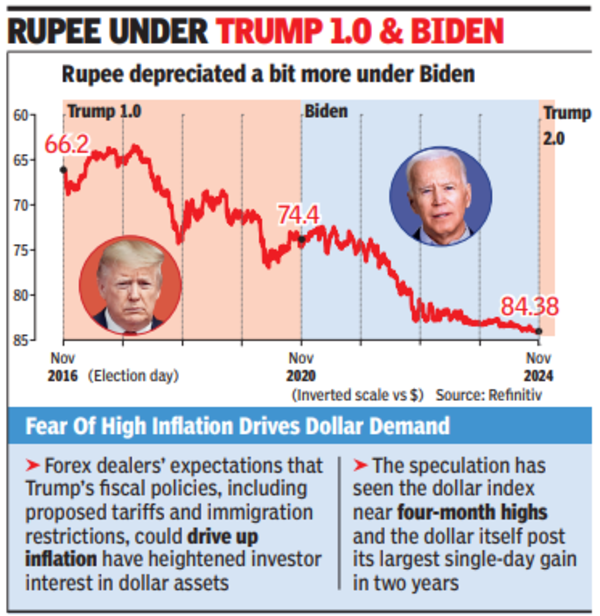

MUMBAI: The rupee dropped to a fresh low against the dollar on Thursday, pressured by sales from foreign portfolio investors in the equity markets and a stronger dollar, amid expectations that Donald Trump’s US presidential win would boost the American currency. The rupee touched 84.38 during the session before settling at 84.37, marking a 0.1% dip from Wednesday’s close of 84.28.

While several Asian currencies strengthened on Thursday and the dollar index saw a slight 0.2% dip to 104.9, the rupee remained under pressure due to strong dollar demand, traders said. Dealers said that the rupee has outperformed many peers in recent days, showing less weakening compared to other Asian currencies. However, strong dollar buying by foreign banks, likely on behalf of custodial clients, kept the currency under strain.

“The present cycle of depreciation should end with the exchange rate around 84.40 to 84.45 and thereafter the rupee may recover to 84.10 provided there is no escalation of the conflict in West Asia. However, the rupee will again come under pressure after Trump takes charge and the tariff wars start,” said K N Dey a forex consultant who advises corporates.

“Trump’s victory has boosted demand for dollar assets, which are also seen as safe havens during times of volatility. The rupee has fared better than many currencies because the RBI is keeping volatility in check. While a weaker rupee will affect importers, I don’t expect any impact on travel and education demand. We’re seeing strong demand for Dec travel,” said M Hariprasad, executive director, EbixCash World Money.

Forex dealers estimate that Trump’s fiscal policies, including proposed tariffs and immigration restrictions, could drive up inflation. These expectations have heightened investor interest in dollar assets, contributing to what Wall Street has dubbed the “Trump trade”. This speculation has seen the dollar index near four-month highs and the dollar itself post its largest single-day gain in two years, rising as much as 2% against a basket of currencies on Wednesday.

According to Dey, although the RBI may deplete some of its reserves, it may calibrate its intervention keeping in mind the adjustment with other emerging market currencies.