President-elect Donald Trump’s Cabinet selections are setting the stage for a renewed clash between the US and China, underscoring potential geopolitical strife.

Driving the news

- Senator Marco Rubio, known for his unrelenting criticism of China’s human rights record and sanctioned by Beijing for his support of measures related to Hong Kong and Xinjiang, is poised to become Secretary of State.

- Representative

Mike Waltz , a self-proclaimed watchdog on Chinese military ambitions, is likely to take the role of national security advisor. - Both are known for their strong anti-China stances, signaling a significant pivot in US foreign policy that may have profound implications for President

Xi Jinping and Communist Party. - As NSA, Waltz would be a key figure handling various international security challenges. These include supporting Ukraine’s armament needs, addressing mounting concerns about Russia-North Korea cooperation, managing Iran-backed militant activities in the Middle East, and facilitating peace negotiations between Israel and its adversaries Hamas and Hezbollah.

- With roots in east-central Florida as a three-term Republican congressman, Waltz brings substantial military and policy experience. Known for his firm stance against China, he advocated for the United States to boycott Beijing’s 2022 Winter Olympics, citing concerns over Covid-19’s origins and the treatment of Uighur Muslims.

- Rubio is likely the most hawkish contender on Trump’s shortlist for secretary of state, having consistently advocated for a robust foreign policy stance against America’s geopolitical adversaries, including China, Iran, and Cuba in recent years.

Why it matters

- Trump’s return to power and his choice of key figures who have historically challenged China’s economic and military ambitions could reignite tensions reminiscent of his first term.

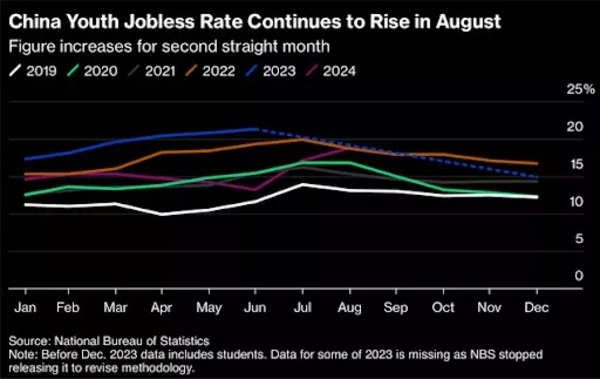

- With Beijing already grappling with internal economic challenges such as—high youth unemployment, a troubled property sector and below-expectation GDP growth—Trump’s return could mean additional economic strain through renewed tariffs and aggressive policies.

- The implications extend beyond just economics; the strategic posturing around Taiwan and alliances in the Indo-Pacific will test China’s global strategy and President Xi Jinping’s leadership.

The big picture

Trump’s first term was defined by an aggressive stance against Beijing, marked by a trade war that disrupted markets and strained relations. The initial conflict included tit-for-tat tariffs and even saw the closure of consulates. By January 2020, a trade agreement known as “Phase One” was signed, which compelled China to buy an additional $200 billion in American goods. However, the outbreak of Covid-19 severely impacted the agreement’s outcomes, with China falling short of its commitments.

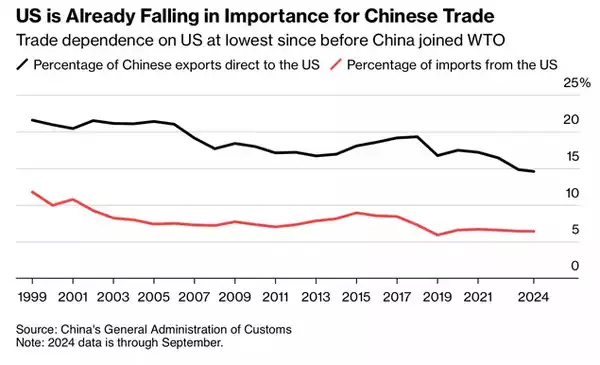

Fast forward to 2024, Trump’s re-election, paired with his plan to impose up to 60% tariffs on Chinese goods, poses an existential challenge to China’s export-driven economy. Such tariffs could potentially halve China’s GDP growth within a year, analysts at UBS warn. These economic stakes come as Xi Jinping attempts to position China as a global leader amid weakening domestic demand and trade diversification away from the US.

What they’re saying

- “It would be a nightmare coming true if [Rubio] got the job,” said Zhu Junwei, a former researcher for the People’s Liberation Army and current director of American research at the Grandview Institution in Beijing.

- Rubio’s appointment would complicate diplomatic ties, as Beijing previously sanctioned him in 2020 after US actions on Hong Kong and Xinjiang.

- Waltz, a former Army Green Beret, has been vocal about China being the greatest strategic threat to the US, advocating for increased military capabilities, particularly in defense of Taiwan.

- During the recent US election campaign, Waltz published an article in the Economist co-authored with former Pentagon strategist Matthew Kroenig, arguing that America should bolster its defense capabilities to deter Chinese aggression toward Taiwan. “America is not building armed forces to deny a Chinese attack on Taiwan,” they wrote. Waltz and his allies argue that Washington must revitalize its defense-industrial base and increase defense spending, a stance that unnerves leaders in Beijing.

Zoom in: Taiwan at the center

Taiwan remains a critical and contentious focal point. China views the island as a breakaway province, essential to national unity, and has repeatedly stated its willingness to use force to reclaim it. The US, under a policy of strategic ambiguity, has traditionally avoided explicitly stating it would defend Taiwan. President Biden’s recent remarks affirming US support in the event of an invasion blurred these long-held lines. Trump, on the other hand, has expressed mixed views. He once critiqued Taiwan for not contributing enough to its defense, suggesting it should pay the US for protection and recommending that it commit 10% of its GDP to defense.

This rhetoric is seen as destabilizing to both sides of the Taiwan Strait. On one hand, it provides China with a narrative to undermine Taiwanese confidence in US support, while on the other, it signals Washington’s potential recalibration of defense strategies under Trump’s leadership. A US withdrawal or strategic pivot could create openings for Beijing to press harder, but Trump’s unpredictable nature leaves the future murky.

Between the lines: Economic strategies and vulnerabilities

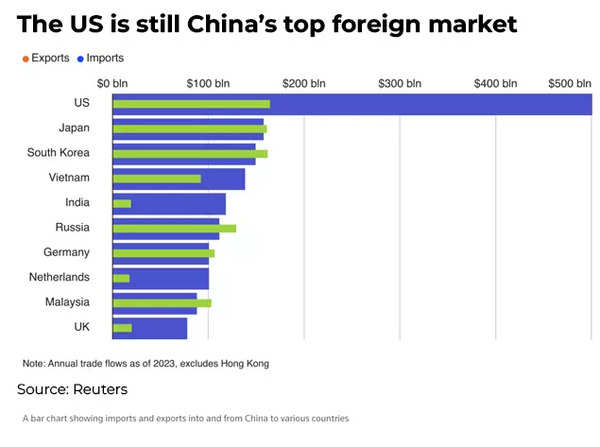

- However, China’s leaders have learned hard lessons from the 2018 trade war and have since taken measures to protect the economy. These include diversifying trade routes and increasing domestic consumption to buffer against external shocks. Export controls on critical materials, such as gallium and germanium used in semiconductors, have been added to China’s retaliatory toolkit. Yet, even with these adjustments, China remains heavily reliant on its export market, with the US being its single largest foreign destination for goods.

- If Trump’s tariff threats become reality, they could disrupt $500 billion worth of annual Chinese exports. The economic repercussions for the US would also be significant, likely leading to inflation and disruptions in global supply chains, but Beijing’s dependence makes it more susceptible.

- Alicia Garcia Herrero, Asia-Pacific chief economist at Natixis, noted, “China can hardly retaliate on 60% tariffs. What China will do is announce a bigger stimulus to counteract so that the market doesn’t penalize China.”

What’s next: Preparing for “Trump 2.0”

China is keenly aware that the US president-elect’s foreign policy could deepen existing divides within the global trade and geopolitical landscape. Beijing’s state-run think tanks are actively debating how best to engage with a Trump administration that appears poised to push hard on economic decoupling. Officials also anticipate a stronger drive to isolate China from alliances, both in Europe and Asia. Trump’s return could thus spur Beijing to seek stronger ties with regions like Africa and Latin America, where it has long invested in infrastructure and economic projects to expand its influence.

However, these strategies may not be enough to counterbalance a renewed US push toward economic and military containment. China’s attempts at decarbonization and technological advancement—both vital for maintaining global competitiveness—could be hampered by stricter export controls from Washington. The US could tighten its grip on advanced technologies, further crippling China’s ambitions in industries such as AI and green tech.

Between hope and caution: The X-factor

There is still some optimism in Beijing that Trump, known for being a “deal-maker,” might be persuaded to broker new agreements if China offers substantial concessions. Former Trump administration officials have noted that while Trump admires President Xi Jinping’s strongman style, he would demand significant compromises from China. The hope for such a deal is tempered by the reality that Trump’s Cabinet, populated with figures like Rubio and Waltz, would lean toward hawkish policies that limit diplomatic flexibility.

Adding complexity is the influence of figures like Elon Musk, who went all-in with his campaign aide and round-the-clock posts on X to help Trump re-elected to the White House. But, when it comes to China, Musk could be said to have “vested interests”. Musk’s Tesla has substantial investments in China. In fact, Tesla’s largest manufacturing plant is in Shanghai.

On the brighter side for China, some analysts suggest Musk could act as an intermediary, advocating for more balanced trade approaches. Yet, Trump’s track record of unpredictability means that even such influences may have limited sway.

The bottom line

Donald Trump’s return to the White House signals an era fraught with strategic risks and opportunities for Beijing. His initial cabinet picks suggest that Trump is likely to follow on his first-term’s hawkish stance against China. There is a chance that Trump 2.0 policies could erode economic stability and limit China’s geopolitical aspirations. From tariff escalations to potential military maneuvers in the Taiwan Strait, Beijing faces a high-stakes game that will test its resilience and strategic acumen.

(With inputs from agencies)