MUMBAI: Climate risks have started to impact the financial system and could pose systemic problems in future, according to RBI.

Besides damage to assets, risks include business disruption, increase in loan losses, and transition risks arising from the shift to a low-carbon economy, which create uncertainty for firms and investors.

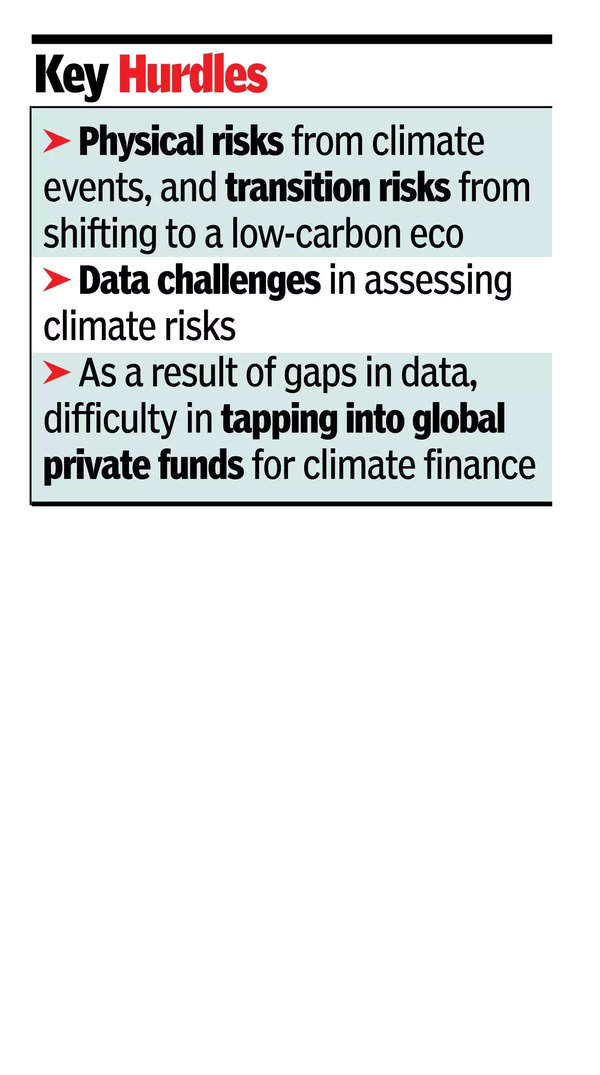

Speaking at a conference organised by the National University of Singapore in New Delhi, RBI deputy governor Rajeshwar Rao said there are two main types of climate-related risks – physical risks from climate events and transition risks associated with shifting to a low-carbon economy. He highlighted data challenges in assessing climate risks, including a lack of uniform methodologies, fragmented accessibility, and absence of historical loan loss data. “We are yet to comprehensively assess climate risks due to data issues. These include fragmented accessibility, differing metrics, and a lack of historical loan loss data and hazard forecasts.”

Rao said that tapping into the global pool of private funds for climate finance was a challenge for India because of data gaps, technical limitations and institutional constraints in setting projects that help cope with the impact of climate change. “While transitioning is crucial, we cannot overlook the immediate impact of climate events. We also need to look at adaptation measures, which currently appear to be a missing link in climate strategies,” Rao said.

Unlike mitigation projects – which focus on reducing greenhouse gas emissions to slow climate change – adaptation projects aim to minimise the risks and damages caused by climate-related events such as extreme weather, rising sea levels, and changing rainfall patterns. Rao added that there was an urgent need for the financial system to address climate risks and play a catalytic role in overcoming related challenges. He stressed on taking collective action to mitigate increasing climate risks, highlighting their significant impact on the economy, society, and financial stability.