BENGALURU: A 28-year-old techie fell prey to digital arrest by fraudsters and lost more than Rs 1.2 crore between Dec 21 and Jan 3. She was even forced to raise a loan of Rs 40 lakh to continue to pay the cybercrooks after they emptied her savings.

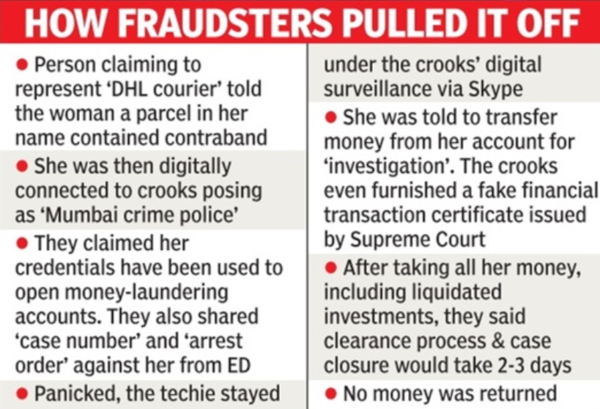

Keerthana (name changed) from east Bengaluru, in her complaint to East CEN Crime police, stated that she received an IVR call from +971 71518333 on Dec 11, purportedly from ‘DHL’ courier. When she followed the instructions, a person claiming to be an executive from the courier spoke to her, saying a parcel sent in her name had six fake passports, ATM cards, and MDMA.

Keerthana told him she hadn’t booked any parcel. She was then told to come to Mumbai and clarify the same to police. When she said she couldn’t immediately go to Mumbai, she was connected to ‘Mumbai crime police’.

Another fraudster, introducing himself as Sunil Dutt Dubey, a police officer from the Mumbai crime team, asked for her documents for background check. The fraudster called her back after a few minutes, saying her documents showed that four bank accounts were opened in four banks in different states in her name, and used for laundering $10.9 million.

The fraudster told her there was a case registered against her by the Directorate of Enforcement (ED) and shared online the case number and an order for arresting her.

They warned her not to talk to anyone and threatened to arrest her physically if she didn’t cooperate with the investigation. Keerthana panicked and agreed to remain in digital arrest and face a virtual investigation.

“From then onwards, I was under a surveillance call from fake police officer Sunil Dutt Dubey over Skype. They sent me an ‘acknowledgement letter from financial department, Mumbai Crime Branch and Central Bureau of Investigation’, which said I would have to transfer 95% of my funds to their bank accounts for investigation. They asked me to liquidate all my investments and assets and send 95% of it via RTGS,” Keerthana told police.

She liquidated her fixed deposits, provident fund and other investments, and transferred Rs 75.6 lakh on Dec 21 to a bank account they had provided. They sent her a fake financial transaction certificate issued by the ‘Supreme Court’, acknowledging receipt of the money and an undertaking to refund the same.

They asked her to submit a bail bond amount of Rs 55.9 lakh towards her assets she couldn’t liquidate. “I did not have any more funds left, so they asked me to take a loan. I approached a few banks which refused to lend me Rs 55 lakh. I informed the fraudsters, who said I could pay them Rs 45 lakh. I raised a loan of Rs 40 lakh and had Rs 5 lakh, which was the 5% balance in my account after transferring Rs 75.6 lakh to the fraudsters,” she said.

She transferred Rs 30 lakh on Dec 30 and Rs 15 lakh on Jan 3. The crooks told her the processing would take 2-3 days and the investigation would be closed after that. When she didn’t get her money back, she realised she had been cheated and approached the cops on Jan 8.

A senior police officer said a case under Information Technology Act and BNS Section 318 (4) (cheating) has been registered, and efforts are on to freeze the money in the fraudsters’ accounts. “Prime Minister Narendra Modi himself has, in his Mann Ki Baat programme, told people not to fall prey to digital arrest fraudsters. Despite awareness efforts by police on social media and public gatherings, nothing seems to be stopping people from trusting these fraudsters and transferring their hard-earned money to them,” he added.