MUMBAI/ NEW DELHI: RBI will retain its policy of currency market intervention to check excessive volatility as part of its overall strategy for macro-economic management, amid reports indicating a more “flexible approach”.

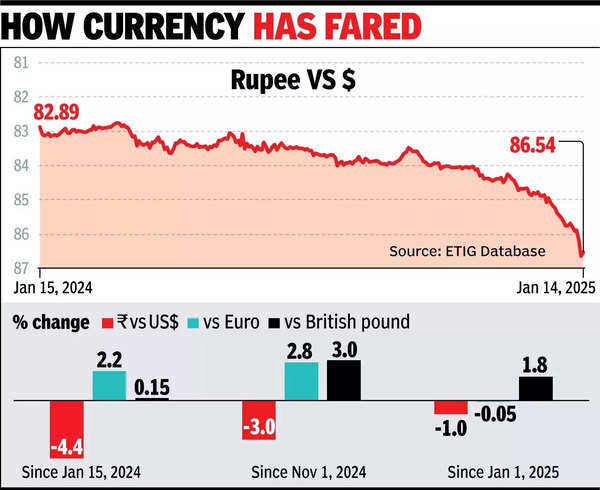

On Tuesday, the Indian currency dropped to close at a new low of 86.63 against the dollar, down from the previous close of 86.58, after touching an intraday low of 86.65, on reports by Reuters and Bloomberg that the central bank, under new governor Sanjay Malhotra had signalled greater flexibility. The rupee came under further pressure following the reports.

Dealers said there was pressure on the rupee because of the non-deliverable forward (NDF) market. In the NDF market, participants speculate on the future exchange rate of the rupee without trading the currency directly. Instead, they settle their bets in dollars based on the rupee’s actual exchange rate at the contract’s maturity. To manage their exposure from these bets, banks buy dollars, which creates pressure on the currency markets.

Over the years, despite pressure from the US and international agencies, RBI and govt have maintained their stand on dealing with currency volatility.

Although recent data suggests that the rupee is over-valued against a basket of other currencies, the policy is also geared to maintain price stability in crucial commodities such as petroleum and edible oil, given the excessive import reliance. A weak currency can add to pressure on inflation at a time when the central bank is focused on ensuring that retail price inflation is anchored close to its target of 4%.

Over the last four months, RBI has aggressively intervened in the market and used the foreign exchange reserve to defend the Indian currency against an appreciating dollar. From a peak of over $705 billion in Sept, India’s foreign exchange reserves dropped to $635 billion at the end of Dec.

The active intervention in the market has also sucked out liquidity as RBI pumped in dollars in exchange for rupees and has faced some criticism for further putting pressure on interest rates.

In any case a weaker currency is seen to be good for exports, provided other currencies also move in the same direction. The greenback continued to rule strong with the dollar index staying firm at 109.5. US stocks opened higher after Bloomberg reported that the incoming Donald Trump administration is considering tariff hikes of 2-5% a month, rather than aggressive one-time increases. While the central bank is tasked with managing interest rates and the exchange, the overall strategy is worked out and implemented in close coordination with the Centre.