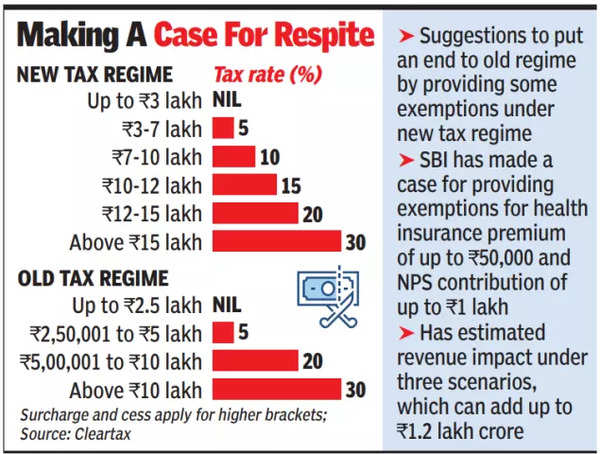

NEW DELHI: Amid expectations of a relief in income tax in the Budget, govt is keen to keep the new tax regime free of concessions, while it looks at raising the threshold and offering concessions through a rejig of slabs.

Income tax rates are usually among the last set of announcements to be finalised and typically ahead of every Budget a case is made to rework them. This year is no different with companies and economists citing weak demand to make a case for lowering the liability, particularly for the middle class. Last year, finance minister Nirmala Sitharaman had enhanced the standard deduction for the salaried to Rs 75,000 and also revised the slabs and said that all the changes announced by her would result in a Rs 17,500 gain.

In the run up to next year’s Budget, which will be presented on Saturday, there have been discussions in govt to raise the standard deduction further, a move that is seen to provide relief to all taxpayers. And, to deal with growing clamour for leaving more money in the pockets of middle-class consumers, proposals around lowering the liability across slabs, including the ones for the higher income segments, have been discussed.

While the Centre is focused on tweaking the rates in the new tax regime, a case is also being made to provide higher concessions for spends such as health insurance and pension, seen to be crucial in a country like India where individuals, barring those in govt, have to fend for themselves. The demand in some quarters is to bring down the curtains on the old tax regime, which is seen to be beneficial to those with allowances, such as house rent allowance, and home loans.

SBI report, for instance, has made a case for providing exemptions for health insurance of up to Rs 50,000 and for NPS contribution of up to Rs 75,000 or Rs 1 lakh. In case the peak rate is retained at 30% with a 15% levy for those with taxable income of Rs 10-15 lakh (against 20% for Rs 12-15 lakh at present), then the Centre stands to lose Rs 16,000 crore to Rs 50,000 crore annually. It has also argued for changes in tax treatment of interest income.

In case the peak rate is cut from 30% to 25% for those with annual taxable income of Rs 15 lakh or more along with health insurance exemption of Rs 50,000 and NPS contribution of Rs 75,000 a year, then the revenue hit works out to Rs 74,000 crore to just under Rs 1.1 lakh crore.

In the third scenario, where the peak rate is cut to 25% along with a 15% levy for those with Rs 10-15 lakh income along with the exemption of Rs 50,000 for health cover and Rs 75,000 for NPS, the report has pegged revenue loss at Rs 85,000 crore to Rs 1.2 lakh crore.

There have also been suggestions to provide benefits for home loans under the new tax regime. Govt officials are, however, averse to introducing concessions and exemptions, arguing that it would result in the new regime slowly going back to its predecessor. At the same time, they suggested that the option should be available and taxpayers can select the one that is beneficial for them.