New Delhi: After a sluggish start in FY25, marked by subdued demand and negative same-store sales growth (SSSG), the Indian fashion and apparel industry is poised for recovery in FY26, according to India Ratings and Research (Ind-Ra).

This optimism is driven by rising disposable incomes, a higher number of wedding days, and favorable monsoons, which are expected to fuel demand, particularly in tier-2 and tier-3 markets.

According to Shiraz Askari, president of Apollo Fashion International Limited (AFIL), “The retail sector in India is at an important turning point. Beneath the current slowdown lie powerful structural shifts – organized retail gaining ground, Gen-Z reshaping consumption patterns, and a clear split between value and premium segments.”

In a recent report by Ind-Ra, segments like fast fashion, ethnic wear, and luxury are set to outperform. Fast fashion, in particular, is witnessing explosive growth, fueled by social media influence and Gen-Z’s appetite for trendy, quick-turnaround clothing. Moreover, major retailers are doubling their store counts in this category, with similar growth projected for FY26.

“Players like Shein re-entering the market and brands ramping up supply chains to meet fast fashion demand are accelerating investments in India’s manufacturing capabilities,” said Ankit Jaipuria, co-founder of ZYOD. “This positions India as a hub for both domestic and global fashion needs.”

Driven by rising affluence and aspiration among middle- and upper-class consumers, ethnic wear and luxury are also gaining traction. Moreover, the e-commerce segment, supported by internet penetration, is expected to grow at a faster rate than brick-and-mortar stores, although physical retail remains relevant for its experiential value, particularly for premium purchases.

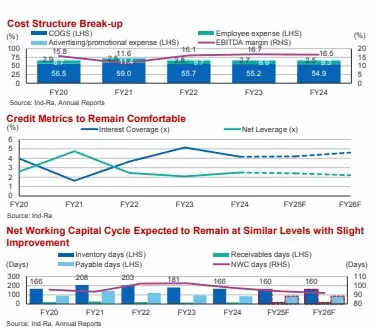

Retailers are adopting a cautious yet strategic approach to expansion, focusing on store productivity and cost optimization. As per Ind-Ra, EBITDA margins remain stable at 16.5 per cent in FY25, with improvements in FY26 as companies enhance efficiency.

“Adaptability will be the key to success,” added Askari. “The ability to marry efficiency with flexibility, sustainability with scalability, and speed with quality will determine the winners in this evolving landscape.”

With projected revenue growth reaching 10.5 per cent in FY26 and segments like fast fashion and premium categories driving momentum, the Indian fashion industry is set for a transformative phase, balancing innovation, scalability, and consumer aspirations

Read also: How Shein, Zudio can ride $50 billion opportunity in India

Credit Metrics and Promotional Spends

Ind-Ra has forecasted neutral credit metrics for FY25, supported by steady profitability and controlled capital expenditure. Improvement is anticipated in FY26 as market conditions recover. Elevated inventory requirements, however, pose a risk of obsolescence, pressuring retailers to maintain efficient inventory management.

Advertising and promotional spending is projected to remain in the 2.5 – 3.0 per cent range. The report said that some retailers are heavily investing in brand elevation and consumer engagement, while others are scaling back, creating a mixed strategy across the sector.

Favorable IPO and QIP fundraising prospects are expected to strengthen equity bases, providing financial resilience for the sector. Looking ahead, Ind-Ra predicts recovery in FY26, driven by improved consumer financial health, higher wedding-related demand, and expansion in organized retail formats such as fast fashion, luxury, and ethnic wear.