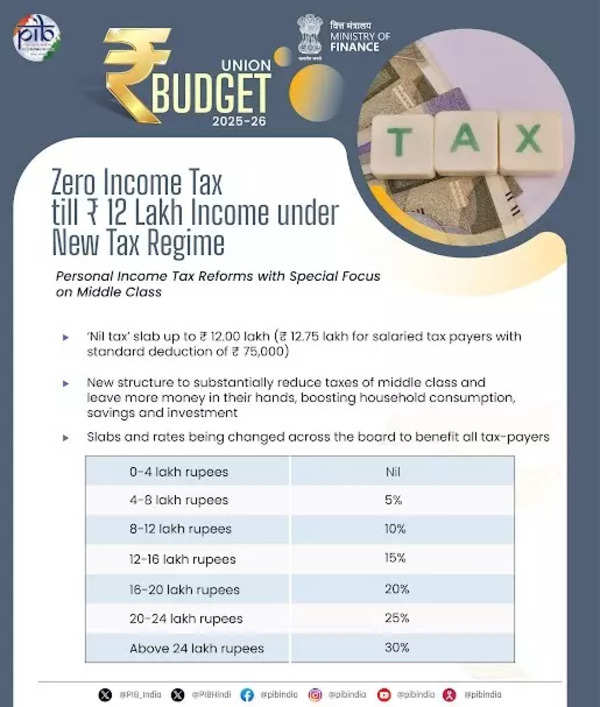

NEW DELHI: Finance Minister Nirmala Sitharaman on Saturday announced a major rejig in income tax slabs, proposing nil tax on income up to Rs 12 lakh per annum under the New Tax Regime. This marks a significant jump in tax exemption limits over the years, providing substantial relief to taxpayers.

New income tax slabs (2025-26):

- Nil tax for income up to Rs 4 lakh

- 5% for income between Rs 4-8 lakh

- 10% for income between Rs 8-12 lakh

- 15% for income between Rs 12-16 lakh

- 20% for income between Rs 16-20 lakh

- 25% for income between Rs 20-24 lakh

- 30% for income above Rs 24 lakh

Sitharaman also stated that individuals earning Rs 12 lakh annually will benefit from a tax relief of Rs 80,000.

Also Read: ‘No tax till income upto Rs 12 lakh per year’, says FM Sitharaman

How tax exemption limits have evolved over the years

The tax exemption threshold has steadily increased, aligning with economic growth and inflation adjustments.

Also Read: Fiscal deficit target pegged at 4.4%, no income tax on income upto 12 lakhs, govt to introduce new I-T bill in Parliament next week

- 2005: Rs 1 lakh

- 2012: Rs 2 lakh

- 2014: Rs 2.5 lakh

- 2019: Rs 5 lakh

- 2023: Rs 7 lakh

- 2025: Rs 12 lakh

The latest move is aimed at boosting disposable income, encouraging savings, and fueling consumption-led economic growth.