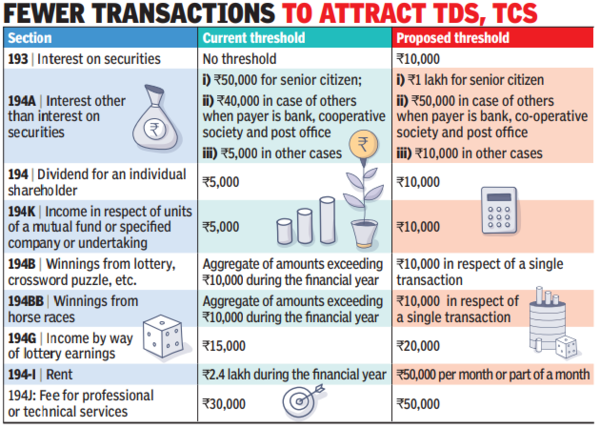

Budget 2025 has sought to bring down the number of transactions liable for tax deducted at source (TDS) by setting higher threshold limits across a spectrum of income streams, thus benefitting small taxpayers receiving small payments.

Similarly, the finance minister also proposed to raise the threshold to collect tax at source (TCS) on remittances under RBI’s Liberalised Remittance Scheme (LRS) from Rs 7 lakh to Rs 10 lakh.

While TDS and TCS are set off against the final tax liability of an individual, a higher threshold definitely helps small taxpayers and props up their immediate cash flow. To illustrate: the threshold on TDS on dividend income has increased from Rs 5,000 to Rs 10,000. This will help a small taxpayer who has insignificant dividend income to avoid the hassle of adjusting the TDS against his tax liability and claiming a refund.

Similarly, gig workers, who work for a multitude of entities, faced a TDS liability on payments made to them in excess of Rs 30,000 in a year by each entity. Section 194-J has increased the threshold limit to Rs 50,000.

However, it should be noted that there has been no change in the TDS rates, which, for example, in case of dividend is 10% and, for gig workers (professional services), is 10%.

Certain finer aspects also need to be kept in mind. If the tenant is an individual, they don’t have to deduct tax at source on paying rent. Thus, only if they have given out their flat to a tenant that is a corporate entity (many companies take flats on lease for their employees) will they benefit from the increase in threshold limits of TDS against rent payment.

An individual can remit up to $2.5 lakh annually without seeking prior approval from Reserve Bank of India – this automatic route is under LRS, which enables them to send money to a child studying overseas (for education) or invest overseas or even indulge in a much-needed overseas vacation. However, outward remittances are subject to TCS.

Tax collection at source requirements lead to an additional cash outflow at the time of remittance and pinch an individual’s pocket. Thus, the increase in threshold limit for TCS on outward remittances brings some respite. The finance minister also proposed to remove TCS on remittances for education purpose where such a remittance is out of a loan taken from a specified financial institution. Currently, in such cases, a TCS of 0.5% is attracted.