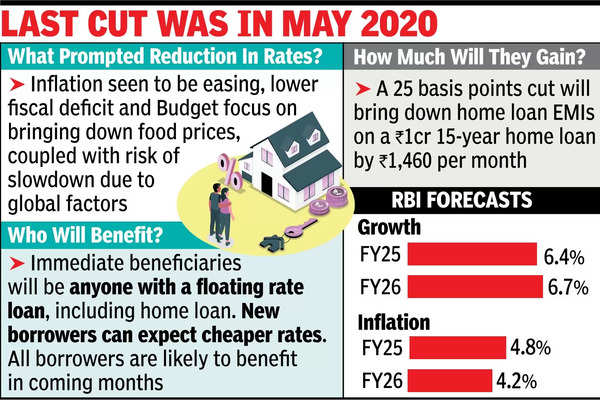

Mumbai: Reserve Bank of India on Friday cut the repo rate by 25 basis points, ending the longest pause in the history of the monetary policy framework, a move which is expected to make loans cheaper.

Announcing the decision, Sanjay Malhotra, who took over as the 26th governor of the central bank in Dec, said the move was driven by easing inflation and concerns over global risks slowing growth.

The rate cut, the first in nearly five years, will immediately lower borrowing costs for millions of home loan and small loan customers with floating rates. The reduction in the rate comes close on the heels of the mega tax relief announced in the 2025-26 Budget and is expected to help drive consumption.

“Considering the existing growth-inflation dynamics, the MPC, while continuing with the neutral stance, felt that a less restrictive monetary policy is more appropriate at the current juncture. The MPC will take a decision in each of its future meetings based on a fresh assessment of the macroeconomic outlook,” Malhotra said in his monetary policy statement – his first since taking over as governor.