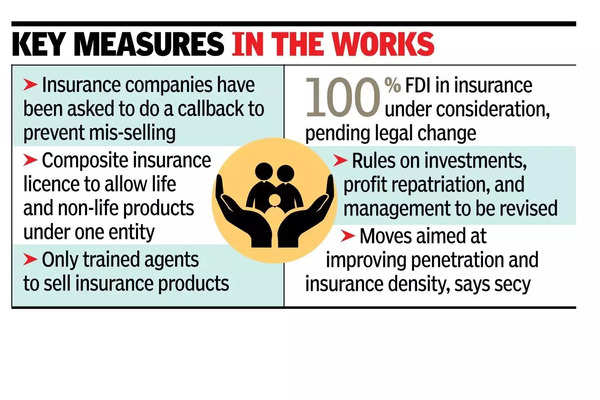

MUMBAI: Govt is working on several measures in the insurance sector, including extending the free-look period on policies and introducing a composite insurance licence. These initiatives aim to reduce mis-selling and increase insurance penetration in the country.

A key step to curb mis-selling is extending the free-look period to one year, instead of the current norm of one month from the date of receipt of the policy. The free-look period allows policyholders to review the terms and conditions after purchasing a policy and cancel it if it does not meet their needs. Govt is also considering a composite insurance licence, which would allow insurance companies to offer both life and non-life insurance products, including health coverage, under a single entity. In addition, there are plans to restrict the sale of insurance products to trained agents only.

The proposed changes in insurance laws were announced by financial services secretary M Nagaraju at a press conference. The secretary said that for 100% FDI in insurance, a change in the law is necessary, and internal consultations on this are nearly complete. He added that along with the legal amendment, rules governing investments, repatriation of profits, and management of insurance companies would also be revised. Once Parliament approves the legislation, these rules will be notified.

“All the reforms we intend to implement in the insurance sector, aimed at improving penetration and insurance density, will be carried out through these reforms announced by the finance minister,” said Nagaraju. Sitharaman had earlier announced the govt’s intention to allow 100% FDI in insurance as part of broader insurance reforms, which would require an amendment to existing laws. He stated that the rules pertaining to insurance companies would also be revised to support these changes. “All the changes we intend to implement to increase insurance penetration, including the introduction of composite licences, will be done as part of the insurance reforms,” he said.

Nagaraju said that mis-selling often occurs when banks engage in unsolicited persuasion of customers. He said that some segments, such as small businesses seeking credit or individuals purchasing houses, are sometimes compelled to buy insurance. To address this, the govt has introduced a one-year free-look period and is encouraging insurance companies to adopt this period.

“If someone wants to surrender the policy, they should be allowed to do so. We have also asked insurance companies to do a callback to prevent mis-selling,” said Nagaraju. He added that private sector companies have been asked to conduct similar callbacks to ensure customers who genuinely want to buy insurance are adequately informed. “We have also instructed banks and other financial institutions that only trained agents in the insurance segment will be allowed to sell, not others. These measures have been taken to reduce complaints,” he said.