Lenskart IPO: Lenskart aims to double its valuation to $10 billion for its forthcoming initial public offering (IPO), as indicated by informed sources. The eyewear company plans to submit its draft documentation in May.

Numerous startups spanning ecommerce, B2B and fintech sectors are preparing for public listings this year. Firms like Zepto, Groww, Bluestone, PharmEasy, Oyo, Ather Energy and Zetwerk are at various phases of their IPO groundwork.

Despite optimistic outlook from banking professionals, these organisations will align their offering prices with prevailing market dynamics during listing, particularly those yet to achieve profitability, following last year’s pattern.

Recent discussions between Lenskart CEO Peyush Bansal and principal investors with IPO bankers have focused on the valuation for the $1-billion public offering. However, the final execution depends on market conditions at the time of launch.

“Work is underway to file the draft red herring prospectus (DRHP) by May so it can… get listed this calendar year,” a source told ET. “Internally, some feel even more aggressive about the valuation, but that may not be in sync with current market conditions and one has to leave money on the table for incoming IPO investors.”

Lenskart IPO plans

“The firm, along with stakeholders, is now ready to go public,” another source indicated to the financial daily, noting limited time remains for a pre-listing round. “That’s the big change in stance now on the IPO.”

While investors had previously discussed public market opportunities over the past year due to Lenskart’s growth and profitability, Bansal had not confirmed these plans. Instead, significant secondary transactions during the previous two years allowed investors to partially sell their holdings.

Also Read | Will banks be open on March 31, 2025? Here’s what the latest RBI direction says

Last June, Lenskart completed a $200-million secondary round at a $5-billion valuation, following an earlier primary capital injection at $4.5 billion. Despite secondaries typically trading at lower values, Lenskart shares have remained attractive to both new and existing investors.

SoftBank and Temasek-backed Lenskart dominates the eyewear sector, with profitable operations in India and anticipated expansion in Thailand. The company’s premium segment includes Owndays, a Japanese brand acquired for $400 million in 2022, according to an informed source.

The company, established 15 years ago and recipient of ET Startup Awards, has achieved an annual revenue run rate of $1 billion (Rs 8,400 crore). Their production capacity stands at 25 million frames and 30-40 million lenses yearly.

The firm holds a substantial ownership in the French omnichannel eyewear brand Le Petit Lunetier.

Also Read| New vs old income tax regime after Budget 2025: 8 salary perks to save around Rs 1.35 lakh income tax under old regime

Lenskart’s total funding, including secondary transactions where existing investors sold shares to new investors, amounts to nearly $2 billion since its establishment.

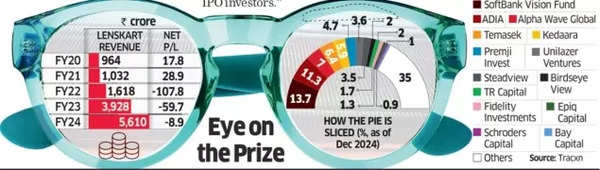

In preparation for its IPO, Lenskart has focused on achieving complete profitability, successfully reducing losses while maintaining steady revenue growth.

The company’s net loss decreased to Rs 10 crore in FY24 from Rs 64 crore in FY23, attributed to technology-enhanced operational efficiencies. A professional associated with Bansal noted, “They (Lenskart) rely and leverage a lot from technology, which leads to operational efficiency in an omnichannel model.”

The operating revenue increased by 43% year-on-year to Rs 5,428 crore in FY24. The company’s Ebitda showed significant improvement, rising to Rs 856 crore in FY24 from Rs 403 crore in FY23.