China’s President Xi Jinping met with leading private sector entrepreneurs on February 17, including Alibaba founder Jack Ma, signaling a shift in Beijing’s approach toward its tech sector after years of regulatory crackdowns. The move comes as China faces economic challenges, declining business confidence, and growing concerns over technological competition with the U.S.

Why it matters

- The meeting is widely seen as an effort to reassure business leaders and investors that China is committed to supporting private enterprises after years of heavy-handed interventions.

- The regulatory clampdown on the tech sector, which began in 2020, wiped trillions off the value of Chinese stocks, stifled innovation, and led to the retreat of high-profile entrepreneurs like Ma from the public eye.

- With an economy struggling to recover from the pandemic, Beijing now needs the private sector more than ever to drive growth and maintain technological competitiveness.

The backdrop

China’s Communist Party has a long history of purging and later rehabilitating figures of influence. Deng Xiaoping was purged three times before leading China out of Maoism. Today, a similar process appears to be at play for business leaders.

Jack Ma’s downfall began with his public criticism of China’s financial regulators in 2020. The government responded by blocking Ant Group’s IPO, launching a probe into Alibaba, and imposing a record fine. Ma disappeared from the public eye for years.

His reemergence alongside Xi suggests a strategic shift, as the government attempts to strike a balance between regulation and economic revival.

By the numbers

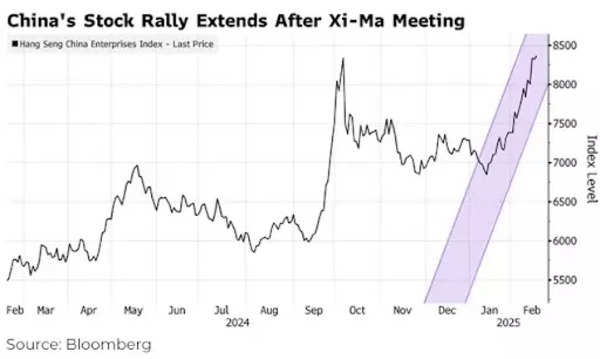

- On February 14, Alibaba’s stock jumped 6.2%—adding $18 billion to its market value—on rumors of Xi’s meeting with business leaders.

- Tencent and Xiaomi saw stock gains of around 7%.

- The Hang Seng Tech Index, tracking China’s largest tech firms, has surged 23% in the past month, with Alibaba shares up over 50%.

What’s driving the shift

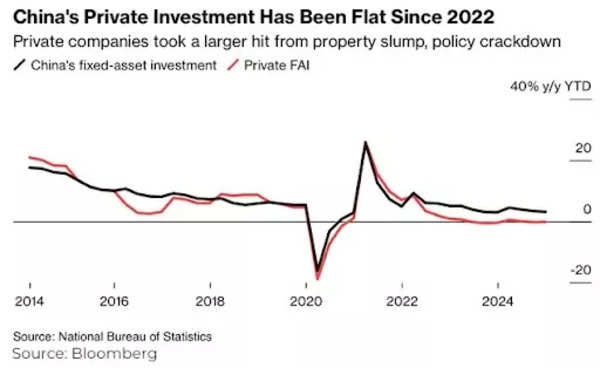

- Economic necessity: Beijing’s crackdown on tech firms erased about $2 trillion from China’s stock markets. With sluggish growth and low investor confidence, the government now needs the private sector to help stabilize the economy.

- AI and tech innovation:

DeepSeek , a Chinese AI firm, has managed to keep up with Silicon Valley despite US chip restrictions. Investors see AI as a potential new growth driver, akin to Alibaba’s 2014 IPO. - Global competition: The US has ramped up efforts to cut China off from key technologies, including semiconductors. To compete, China must rely on private sector innovation, especially in AI and cloud computing.

- “It’s a tacit acknowledgement that the Chinese government needs private-sector firms for its tech rivalry with the United States,” Christopher Beddor, deputy China research director at Gavekal Dragonomics in Hong Kong, told Reuters. “The government has no choice but to support them if it wants to compete with the United States.”

The bigger picture

- Over the past few years, China’s regulatory crackdowns on tech giants sent a clear message: the government is in control. These crackdowns targeted monopolistic practices, financial risks, and data security concerns.

- The crackdown on Alibaba and Ant Group was followed by tighter regulations on private tutoring, gaming, and online lending, causing widespread investor uncertainty.

- As China’s economy continues to face headwinds, including a sluggish property market and weak consumer demand, reversing sentiment toward the private sector is becoming a priority.

Between the lines

Xi’s meeting reassured entrepreneurs of policy stability, but questions remain about the extent of real regulatory easing.

While Beijing acknowledges the private sector’s importance, control remains paramount. Tech firms are still expected to align with state priorities, particularly in AI and cybersecurity.

Despite the meeting’s positive signals, China’s business confidence remains fragile. Entrepreneurs want more than rhetoric; they need tangible policy changes, such as eased IPO approvals and relaxed financing restrictions.

What they are saying

Analysts see this meeting as a significant shift in China’s approach to the private sector, but remain cautious about long-term implications.

Renewed enthusiasm for China’s tech firms is based mostly on the false premise that DeepSeek’s breakthrough in AI will drive a renaissance in the sector’s earnings outlook. We disagree and believe the earnings outlook at most firms remains largely unchanged. Rising economic uncertainty, plus the risk of escalating tensions with the US, make for an uncertain sector outlook in 2025

Analysts Robert Lea and Jasmine Lyu at Bloomberg

According to a Reuters report, here are some expert comments on the meeting:

Charlie Chai, Shanghai-based analyst at 86Research: “We believe the event will likely be followed by concrete pro-technology policies. Potential moves include shifting focus from ‘national security risks and social externalities’ to a more risk-taking approach to technology application.

“(This would) include potentially accelerating the mass deployment of generative AI, autonomous driving, and humanoid robotics.

“Similarly, securities regulators are likely to adopt a more accommodative stance, allowing technology companies greater access to capital markets to finance growth, which could help resolve uncertainties around listing and re-listing timelines (e.g., Didi, Ant, Temu).”

Alfredo Montufar-Helu, head of think tank The Conference Board’s China Center: “That President Xi chaired this symposium signals a recognition from China’s top party leadership of the significant role that Chinese private firms can play in the support of growth, and, more importantly, in realising the technological ambitions of China in the face of growing Western restrictions.

“We should expect more support to the private sector, especially in areas of strategic importance for the country.

“Despite their flaws, DeepSeek now, and Huawei’s Kirin chip before, send a strong message to the West: that China not only has the intention but also resources and capacity to innovate its way out of technology restrictions, no matter how costly.”

Fred Hu, founder & chairman, Primavera Capital Group, Hong Kong: “President Xi’s meeting with Chinese private entrepreneurs clearly represents a major course correction.

“The private sector, long the backbone of the Chinese economy and the most important growth engine, has been battered in recent years by mounting policy and regulatory uncertainties, with dire consequences to China’s economy, and worse, to its labour market with rising youth unemployment.

“The leadership’s well-publicised meeting with some of the country’s most high-profile entrepreneurs, such as Jack Ma, could not come at a more critical juncture.

“It should help reassure rattled entrepreneurs and lift up business and investor confidence in China.”

Tom Nunlist, associate director at policy research consultancy Trivium China: “The tech crackdown has been definitively over for some time and the government has been trying to push increased confidence for the private sector, and tech sector, in particular.

“There’s been some continued scepticism because at the end of the day it’s Xi Jinping’s opinion that matters most. You cannot do better than having Xi Jinping personally give the nod of approval.

“I think it took so long to have this meeting because Xi is changing course.”

Xiaoyan Zhang, chair professor of finance, Tsinghua University, Beijing: “I think the meeting’s purpose is to make sure that the private sector understands, for the stability and for the growth of the economy, they are a very important part of the economy.

“I think the purpose is to tell them, ‘We want to support you. We need you to boost innovation, technological innovation, and we need you to boost consumption.’ I think (the purpose is) to inject confidence in there.”

Gary Ng, senior economist for Natixis, Hong Kong: “Despite the rising opportunities in the case of DeepSeek, it is also about guiding the private sector in the government-led direction and containing the potential risks to compete with the United States.

“The market reads it as a positive signal to include Jack Ma in such a meeting and hope for the end of the tech crackdown. Still, the regulatory environment is the black box.

“As most AI development happens in the private sector, we cannot entirely rule out the outcome of a tighter-than-market-expected regulatory environment than we see now.”

What’s next

- Annual legislative leeting in March: Officials are expected to unveil the economic blueprint for 2025, with potential measures to support private enterprises.

- IPO regulations: Beijing’s stance on overseas listings remains uncertain, with reports of companies like Shein navigating opaque regulatory processes.

- AI development: China’s push into AI and advanced computing will be a key indicator of how much leeway private firms receive in shaping the country’s technological future.

Will this change last?

- Skeptics argue that while Xi’s meeting signals a shift, it does not necessarily mean a return to the unregulated boom years of the past.

- Government control over the tech sector remains strong. Beijing still mandates strict compliance with its regulations, ensuring that tech firms prioritize national interests over profit-driven motives.

- The concept of “common prosperity” remains a key priority, meaning that tech firms will be expected to contribute to social and economic programs.

- Entrepreneurs must now play by the party’s rules—or face exile. While Xi’s latest overtures may boost investor sentiment, they do little to erase the regulatory scars left by years of crackdowns. Business leaders may be allowed back into the fold, but they will do so under the watchful eye of the Communist Party.

(With inputs from agencies)