Universal Pension Scheme: India is exploring a nationwide voluntary pension initiative that would provide social security coverage to all citizens, according to officials. Initial discussions have begun at the labour and employment ministry regarding this comprehensive pension programme.

Officials indicate that the fundamental structure of the scheme, under the Employees’ Provident Fund Organisation (EPFO), is currently under development.

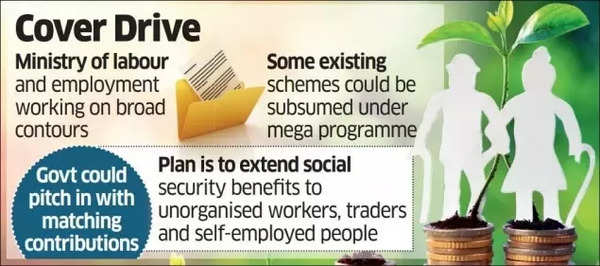

The objective is to provide benefits to workers in the unorganised sector, traders, self-employed individuals, and any person aged 18 and above who wishes to receive pension benefits after turning 60.

Universal Pension Scheme

“The scheme, which would be voluntary and contributory, will not be tied to employment and hence will be open for everyone to contribute and earn a pension,” a senior government official told ET.

Following the planning phase, the ministry will engage with stakeholders to finalise the Universal Pension Scheme details.

The initiative aims to incorporate existing central schemes to enhance their appeal and simplify procedures whilst expanding coverage across society.

The government is considering consolidating various pension programmes, including PM-SYM and NPS-Traders, into a comprehensive scheme. These optional programmes provide subscribers aged 60 and above with a monthly pension of ₹3,000, based on contributions ranging from ₹55 to ₹200, matched by government funding.

Also Read | What is LIC Smart Pension Plan? Top 10 FAQs answered on new retirement planning scheme

The unified scheme might incorporate the Atal Pension Yojana, which is presently overseen by PFRDA.

The proposal suggests utilising the cess collected through the Building and Other Construction Workers Act to provide pensions for construction industry workers.

The central government may encourage states to integrate their pension schemes into this unified programme, ensuring equitable distribution of government contributions, enhanced pension amounts and elimination of duplicate beneficiaries.

By 2036, India’s elderly population (aged 60 and above) is projected to reach 227 million, constituting 15% of the total population, increasing to 347 million (20%) by 2050.

Several developed nations, including the US, Europe, Canada, Russia and China, maintain comprehensive social insurance systems encompassing social security, pensions, healthcare and unemployment benefits.

Currently, India’s social security framework primarily comprises the provident fund system, alongside old-age pensions and health insurance provided by the Centre to specific beneficiaries, predominantly those living below the poverty line.