MUMBAI: Foreign fund managers – based anywhere between New York and Singapore – play an outsized role in determining your mutual fund returns.

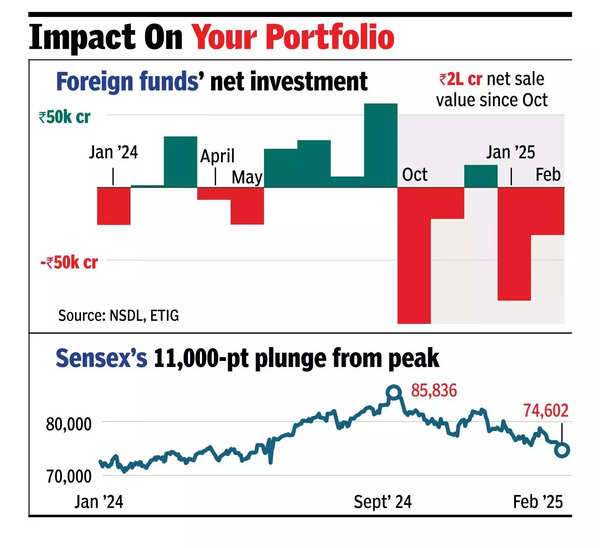

Foreign funds, who invest on behalf of their clients, have sold over Rs 1-lakh-crore-worth of Indian stocks this year in less than two months. And since Oct last year, they have sold over Rs 2 lakh crore – higher than the record Rs 1.7 lakh crore net inflow in 2023. The sensex has plunged more than 11,000 points from its Sept-end high near the 86k mark – thanks to foreign fund selling, at least in part.

The foreign fund flight has two major reasons, market players said.

- India is just not attractive enough for them currently due to weak earnings growth, and demand. Lower returns in dollar terms due to the falling rupee is another factor.

- Some customers of foreign funds are looking to redeem money from emerging market schemes – thanks to the fresh Trump-driven global turmoil and the surprising Wall Street resilience. To meet these redemption requests, foreign funds have got to sell stocks, and India happens to be the most ‘ripe’ one among

emerging markets , due to the post-pandemic D-Street rally.

“Even if India was attractive right now, foreign funds don’t have money to invest because money is going back into the US,” Pratik Gupta, CEO & co-head, Kotak Institutional Equities, said. While emerging market fund managers expect inflows in the second half of the year, India will not be their top priority given slowing growth and relatively expensive valuations, he added.

According to an analyst, foreign fund selling intensified after Trump’s election win, which lifted the dollar and US bond yields. “When US 10-year bond yields are above 4.5%, foreign funds don’t need to take the risk of investing in emerging markets, particularly when the valuations are high, as in India,” V K Vijayakumar, chief investment strategist, Geojit Financial Services, told TOI.

Capital gains tax is also beginning to bite foreign fund managers. “The capital gains tax didn’t matter as much in the last few years when Indian equity returns stood at over 20% and the rupee was relatively stable… But now return expectations have come down sharply,” Gupta said.

What will stop the selling?

Signs of consumption demand picking up, improvement in earnings outlook, or at least ‘reasonable’ valuations.”GDP growth above 6-7% would support corporate earnings and attract foreign investors,” Inderbir Singh Jolly, CEO (wealth), PL Capital, told TOI. According to him, other factors include: macroeconomic & rupee stability, inflation control, and investor-friendly policies.

While they can sway D-St stocks, India’s share in foreign funds is still small, market player said. Foreign investors own about $800-billion worth of Indian stocks, which is roughly 16% of India’s market cap. The India exposure is marginal in the global context, they said. “However, foreign funds are not ‘price-insensitive’. If the Indian market were to see further correction, the selling would perhaps slow as they would start seeing value in some stocks,” Gupta said.