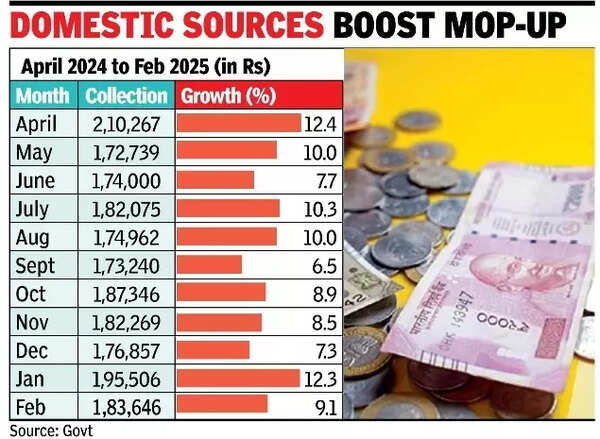

NEW DELHI: Goods and services tax collections rose 9.1% to Rs 183,646 crore during February on the back of double-digit rise in the mop up from domestic sources.

On a gross basis, GST from domestic sources, which refers to transactions within the country, rose 10.2% to Rs 1,41,945 crore, while those related to imports were up 5.4%, indicating that the value of shipments into the country saw limited increase.

“The robust GST collection figures indicate that the Indian economy is withstanding global economic challenges. The consistent rise in domestic GST revenue compared to import-related collections points to effective implementation of Atmanirbhar Bharat policies,” said Saurabh Agarwal, tax partner at consulting firm EY.

Tax experts are also drawing comfort from a healthy growth in refunds, which were estimated to have increased 17.3% to Rs 20,889 crore. On a net basis, collections were up 8.1% at Rs Rs 1,62,758 crore, official data showed.

“This year’s GST collection is almost on target and that is one of the reasons that the actual fiscal deficit for FY24-25 of 4.8% is estimated to be below the budgeted 4.9%. It is heartening to see that the growth of GST on imports is 7.2% only vis-a-vis growth in domestic GST Collection of 10.1%. If at all, It is an indication that India is getting more ‘Atmanirbhar’. Coupled with this, an increase of 15.8% in refunds (including export refunds) is a positive sign. It shows that now India is also increasingly ‘making for the world’. Overall, amidst geo-political headwinds, India seems to be managing well,” said Vivek Jalan, partner at Tax Connect Advisory Services.

Haryana and Tripura reported an increase of 20% and 21%, respectively. At the other end of the spectrum, Mizoram (-16%), Manipur (-9%) and J&K (-2%) were the laggards, while Telangana (1% increase), Gujarat (3%) and Andhra Pradesh (4%) reported a muted rise.