The Reserve Bank of India (RBI) is reportedly examining the utilisation of a two-decade-old foreign exchange regulation that was initially established to assist Indian students studying abroad. Students have been quietly facilitating international money transfers for years, a practice that is now gaining attention.

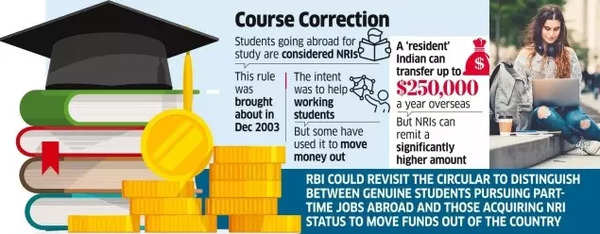

The central bank’s 2003 regulation granted ‘non-resident Indian’ (NRI) status to overseas students. This measure was primarily implemented to support students who sought employment abroad to fund their education. Previously, these students were classified as ‘residents’. The change aimed to protect working students from inadvertently violating the Foreign Exchange Management Act (FEMA) of 2000, which required residents to repatriate their foreign earnings.

According to an ET report, affluent Indian families realised that their children’s NRI status could serve as an avenue for substantial international fund transfers, an option not available to ‘resident’ parents under existing regulations.

Course correction

“Once a person is treated as a non-resident under FEMA, he is entitled to freely repatriate all current income in India and all capital sums up to $1 million every financial year from his NRO bank account… compared to a resident who can remit only $250,000. If RBI is considering reviewing this circular, it may be worthwhile for the regulator to draw a distinction for those students who go for long-duration courses, say, more than 4 years. Such persons could continue to be classified as non-residents under FEMA,” Anup P. Shah, partner of the CA firm Pravin P. Shah & Company, was quoted as saying.

Various tax and FEMA experts who spoke with the financial daily indicated that RBI might review the circular to establish clear guidelines between legitimate students with overseas part-time employment and those seeking NRI status solely for fund transfers abroad.

Also Read | Turnaround from importer to exporter! India now shipping Apple product components to China & Vietnam

Moin Ladha, partner at Khaitan & Co, explains, “The primary criteria for determining residency is an individual’s intention to leave India for an uncertain period.” He notes the distinction between long-term university students and those attending brief courses. “The regulators or the government may be seeking to clarify this distinction to prevent the misuse of enhanced financial limits available to NRIs by students enrolling in short-term programs without the intention or ability to secure employment or remain abroad.”

Some observers suggest that substantial fund transfers might have been integral to the strategy of affluent families choosing overseas relocation and foreign citizenship. Current regulations permit previously transferred or received funds to remain abroad, even if the student later returns to establish residency in India.

Also Read | Taxpayers take note! Crack down against 40,000 TDS/TCS defaulters planned by Income Tax department

Rajesh P. Shah, partner at Jayantilal Thakkar & Company, a firm specialising in tax and FEMA matters, states, “The 2003 circular on students becoming NRIs was issued a year RBI allowed LRS. Now after 22 years, it is crystal clear that RBI considers such students as NRIs. However, students should keep in mind the intention of RBI behind the circular rather than using it for the ultimate benefit of their families. RBI may intervene to restrict use of such circular if they deem fit.”