MUMBAI: After a resurgent IPO run in 2024, startups are back to the drawing board, reassessing their listing plans amid choppy markets. Companies are considering reducing the issue size and are resetting their valuation expectations. Some are delaying IPOs and opting for private funding instead.

Of the estimated 20 new-age companies planning IPOs this year, many may pivot towards private funding if volatility persists, an investment banker told TOI on a condition of anonymity. “Given the market uncertainty, some firms are now exploring private market transactions, especially with private equity players sitting on significant dry powder (capital). While public markets have provided better listing opportunities in the last two years, private capital is becoming an increasingly viable alternative,” the banker said.

It is likely that fewer new-age IPOs will materialise this calendar and fiscal year (FY26) than initial projections, said Neha Agarwal, MD & head, equity capital markets at JM Financial Institutional Securities. “There is a clear expectation that IPO sizes and valuations will be reassessed,” said Agarwal.

Many startups that are preparing to file their draft IPO papers are opting for the confidential filing route as they navigate an unpredictable market. A confidential filing allows a company the flexibility to adjust the issue size and time of listing while keeping its financial details private. “Usually, windows of heightened market volatility, such as the one we are experiencing right now, see a dip in IPO launches in the markets,” said Vishal Bangard, head of equity capital markets at IIFL Capital.

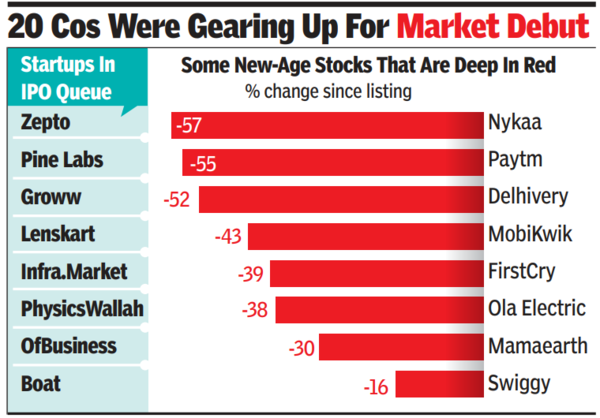

Zepto, Groww, Infra.Market, Pine Labs, Lenskart are among startups that were eyeing a public market debut this year. Not to say that companies have put brakes on IPO process altogether; they are holding discussions with investment bankers to chart out their listing plans and many firms are going ahead and filing draft papers so that as and when a window of opportunity opens up, they can go and hit the markets.

The IPO frenzy seen in the past 6-9 months has faded and investor appetite remains tepid, said Keyur Majumdar, managing partner at Bay Capital. “One can certainly expect deferment of IPOs in general and not just for new age IPOs,” Majumdar said. New-age companies flexible with IPO timelines are showing an increased inclination to take the pre-IPO route (private funding), said Aalok Shah, managing director and co-head of India at Rothschild & Co.