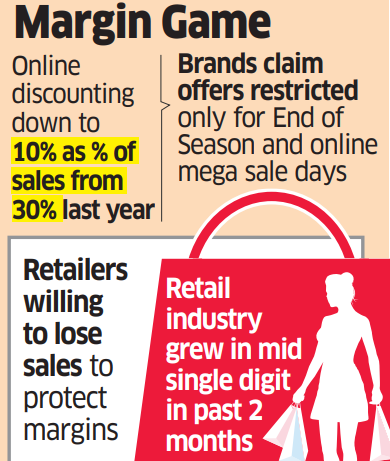

Mumbai | New Delhi: Large Indian retailers are starting to shun discounts and have fewer product price markdowns online.

The shift in strategy at retail chains such as Shoppers Stop, Arvind Fashions, Aditya Birla Fashion and Retail and Lifestyle tracks their inability to reboot sales online sufficiently despite running persistent discounts including the more-recent End-of-Season-Sales (EOSS) and Republic Day sales.

Online still under pressure

These discounts included the more-recent End-of-SeasonSales (EOSS) and Republic Day sales.

Brands are also sharpening their focus on brick-andmortar stores to sustain profitable growth, moving away from the fiercely competitive online market.

“We have completely come out of discounting online and moved to fresh stock at full price. As a result, we have seen our brick-and-mortar sales recover, but online sales are still struggling since the channel is used to having discounts,” said Devarajan Iyer, chief executive officer at Lifestyle International, India’s biggest departmental chain.

“We give offers only to liquidate old stock but discounted merchandise as a percentage of sales has come down dramatically.”

Retailers have been battling a sales slowdown for the past two years as inflation and financial pressures weighed on consumer spending. In addition, the market was witness to a flurry of digital-first brands which thrived on discounts, especially after the pandemic. Such brands not only gained market share at the expense of the established retailers but also forced some to lower prices.

Biju Kassim, CEO-beauty at Shoppers Stop, said the market is overheated and it is tough to continue to sustain offers, and promotions, and grow the business simultaneously. “Obviously, we are not going to ignore the competitive landscape, but we’ll try and do what is appropriate so that we don’t get into that desperate measure and get suck-ed into that situation where then you are compelled to burn to earn,” said Kassim.

Brands said in spite of cutting back on discounts, marketplaces are reducing their own margins and offering additional discounts especially during EOSS or special days to boost revenues. This is despite foreign direct investment rules on ecommerce restricting marketplaces from influencing the selling price of goods and services.

“We mostly do discounting only during End of Season Sale or such other select similar occasions and all such discounts are controlled by us. Marketplaces do not add to the discount that we as a brand are offering. We ensure that the brand values are not diluted and hence we control the pricing,” said Rajesh Jain, managing director at Lacoste India.

Neetu Kashiramka, managing director at luggage maker VIP Industries, said online platforms are giving discounts and in fact, selling below their purchase price. “That is the big problem, and they are investing in the brand (themselves) and not in us,” she said.

In India, more than a third of apparel sold by retailers on discounts or EOSS are due to mismatches between planned inventory and actual sales, according to Vector Consulting Group which partnered NielsenIQ for a report.

Companies, however, said they are tightening their back ends to narrow the demand-supply gap. “In the past, there was also a lot of inventory from the liquidation of old season merchandise. So, as we made our inventory sharper, we have had less of that (discount). The kind of business that we want to grow within ecommerce is a lesser discount, more profitable growth path,” Ashish Dikshit, managing director of Aditya Birla Fashion & Retail, told investors recently.