Banks across India will introduce a new format to help account holders or nominees recover unclaimed deposits exceeding ₹78,213 crore, according to informed sources.

Banks are implementing new RBI guidelines for unclaimed deposits and inactive accounts, effective April 1. The guidelines require banks to display unclaimed deposit details on their websites, including account holder information and a public search feature.

The streamlined process will feature standardised application and declaration forms, along with a uniform set of documents required for deposit reclamation.

Applicants must furnish basic information including name, mobile number and address. The respective bank branch will verify and process these applications, according to a public sector bank official.

Unclaimed deposits

“The recommendations of a working group set up to look into the issue of unclaimed deposits have been accepted,” a bank executive told ET. “From FY26, the online retrieval mechanism will be fully operationalised.”

Also Read | Are your bank deposits insured if bank fails? Up to Rs 5 lakh deposit insurance scheme explained

A working group comprising senior bankers from state-run institutions was established last year after discussions with the Reserve Bank of India (RBI), government officials and other stakeholders to suggest methods for expediting unclaimed funds settlement.

The standardised format, developed by public sector banks, will be distributed to private sector institutions through the Indian Banks’ Association.

A senior banking official confirmed the process will function smoothly across all banks.

“Once a customer has filled in the details, it will ensure that the concerned bank branch reaches out to the customer for additional verification if required, and transfers the amount to the verified account,” he said.

Also Read | Unified Pension Scheme: Central government employees take note – UPS rules notified; check eligibility, contribution

Currently, customers must check unclaimed deposits via RBI’s UDGAM portal and subsequently visit their bank branch to claim funds.

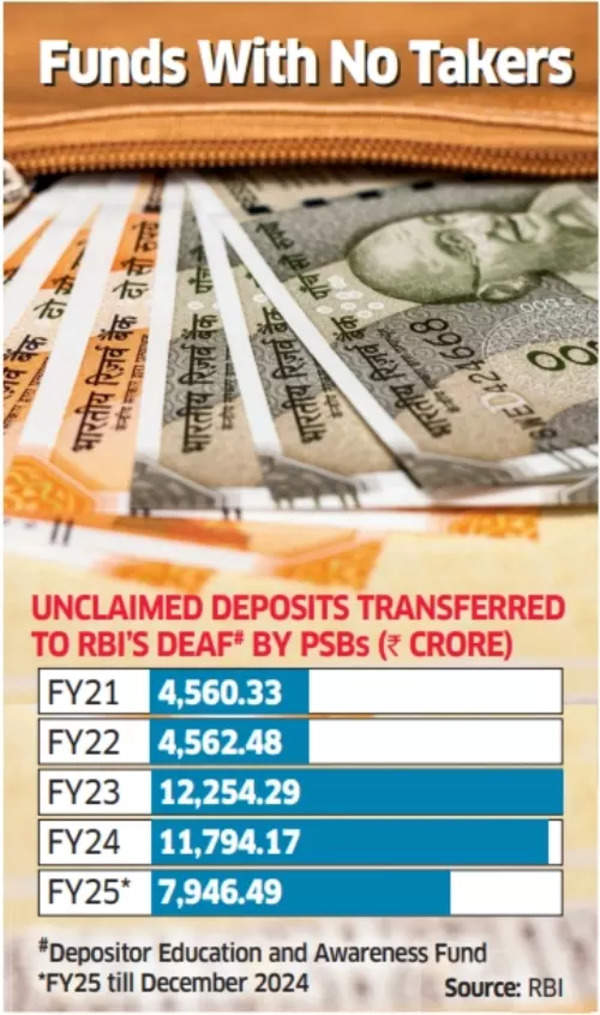

The RBI’s Depositor Education and Awareness (DEA) Fund receives deposits from accounts inactive for 10 years or more. As of March 2024, the fund holds ₹78,213 crore, showing a 26% increase from the previous year.

The Banking Laws (Amendment) Bill, 2024, introduced in August, allows up to four nominees per bank account, an increase from the previous single nominee limit.

Finance Minister Nirmala Sitharaman has directed financial regulators to initiate a special drive for settling unclaimed deposits and claims across various financial sectors, including banks, shares, dividends, mutual funds and insurance.

Also Read | Gratuity eligibility, payout and formula: Leaving job before 5 years? Here’s how you can still get gratuity