MUMBAI: RBI governor Sanjay Malhotra said he was more concerned about the impact of tariffs on growth rather than inflation, given the constraining effect of US President Donald Trump‘s levies on the global economy.

“First and foremost, uncertainty in itself dampens growth by affecting investment and spending decisions of businesses and households. Second, the dent on global growth due to trade frictions will impede domestic growth. Third, higher tariffs shall have a negative impact on net exports,” Malhotra said on Wednesday.

“There are, however, several known unknowns – the impact of relative tariffs, the elasticities of our export and import demand; and the policy measures adopted by govt including the proposed foreign trade agreement with the US, to name a few. These make the quantification of the adverse impact difficult,” he said.

The central bank governor asserted that while global trade and policy uncertainties shall impede growth, its impact on domestic inflation, while requiring RBI to to be vigilant, is not expected to be of high concern.

Noting that the impact of primary impact of these tariffs on India vis-a-vis some of the other countries, is much less because of lower share of exports to GDP, Malhotra sought to boost domestic drivers of growth by making it easier for banks to reach small borrowers and and allowing lenders serving the last mile to partner larger institutions to extend loans to small businesses through the co-lending model.

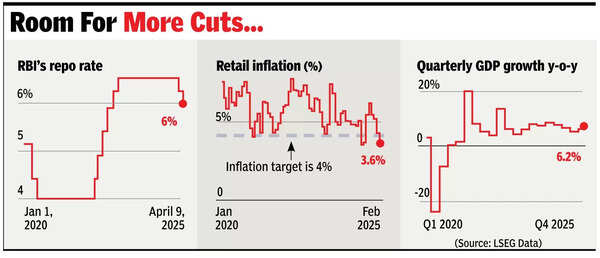

“Most of the forecasts now for the global GDP growth have come down by at least 20-30 basis points. Not only for this year, even for next year. We have reduced the growth rate by 20 basis points for this year primarily because of these uncertainties. Inflation will also decline because of the demand that is going to shrink as a result of the tariff friction, and food prices have also gone down. So all in all, more than inflation, we are concerned about its impact on growth,” said Malhotra. He lowered the growth and inflation forecast for 2025-26 by 20bps to 6.5% and 4%, respectively. With inflation coming within the target, Malhotra hinted at further rate cuts. ” Going forward, the trend (for real rates) is going to be downwards,” he said.

According to Malhotra, the RBI’s rate cut actions will take time to make its way through the economy. ” When we raised the repo by 250 basis points, it took 6-9 months for the interest rates to decrease in response to the policy repo rate decrease.”