Mumbai: Diamond houses, jewellers, and gem stores will soon be blacklisted by banks if they fail to disclose the ‘ultimate beneficial owners’ (UBOs) of their trading partners.

Identifying the UBOs, or the true owners, would test the genuineness of foreign buyers and sellers, curb sham exports and imports, and expose rogue firms using cross-border trades in gold jewellery and other precious stones as a subterfuge for irregular fund transfers and hawala deals.

The trading fraternity is in touch with local banks to put in place a framework under which such firms using overseas shell companies as trade counterparties would find it difficult to access export credit and working capital. The trade body, representing over 9,500 jewellers and diamantaires, assured this at a meeting last week to the Financial Action Task Force (FATF), the global body to combat money laundering (ML) and terror funding (TF), a person familiar with the FATF proceedings told ET.

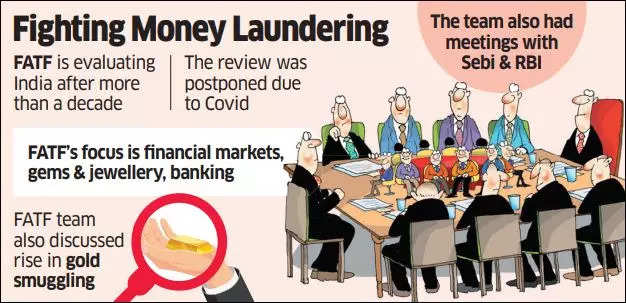

After more than a decade, a FATF team visited the country this month to interact with some of the key institutions and financial market regulators, to evaluate India’s anti-money laundering preparedness.

The initiative to trace UBOs in the jewellery trade is being led by the main industry body Gem & Jewellery Export Promotion Council (GJEPC), which had introduced the ‘MYKYC’ regime in 2019 in the wake of the Nirav Modi-Mehul Choksi scam, making it mandatory for members to reveal UBOs of companies and IDs and personal details of proprietors of domestic firms.

“However, such disclosures are not compulsory in other countries, say in the UAE, where firms may choose not to register themselves under a strict KYC (know your customer) system. So, the onus would now be on Indian firms exporting jewellery or importing rough diamonds or exporting polished stones to insist on asking their foreign buyers and sellers to share the UBOs and other details. Already, ECGC is demanding UBOs etc for giving cover,” said another industry person.

The state-owned ECGC, under the ministry of commerce and industry, provides credit risk insurance and related services for exports. The stance taken by ECGC could make it easier to execute the regime of linking bank credit with UBO details of offshore counterparties.

“The issue of gold smuggling also cropped up in the interaction with FATF. However, unlike some of the other countries, the surge in smuggling in India is largely due to higher import duty, and not for finance terror,” said the person.

The last FATF evaluation of India happened in 2010. Even though the FATF is not backed by a statute, its findings may influence capital allocation by international investors in portfolio as well as direct investments. A country which finds itself in the FATF grey list or under enhanced monitoring regime stands the risk of losing out on hard currency inflows.

The ongoing FAF assessment also follows the Hindenburg report on Adani companies following which the Securities & Exchange Board of India (Sebi) has come out with stringent UBO disclosure regulations to spot the last natural persons controlling foreign portfolio investors (FPIs) – particularly FPIs over-exposed to stocks of companies belonging to any corporate group.

Thanks to the Covid-19 pandemic, the mutual evaluation of India was postponed to 2023. In June 2013, the FATF had recognised that India had made significant progress in addressing deficiencies identified in its mutual evaluation report and decided that the country should be removed from the regular follow-up process.

The Prevention of Money Laundering Act, The Unlawful Activities (Prevention) Act, 1967 (UAPA) (which was amended in 2004 to criminalise, inter alia, terrorist financing), and subsequent and recent amendments to the PMLA have strengthened the AML framework.

A finance ministry notification earlier this year designated professionals such as a practising chartered accountant, company secretary, certified management accountant as ‘reporting entities’ under PMLA for certain transactions carried out on behalf of clients.