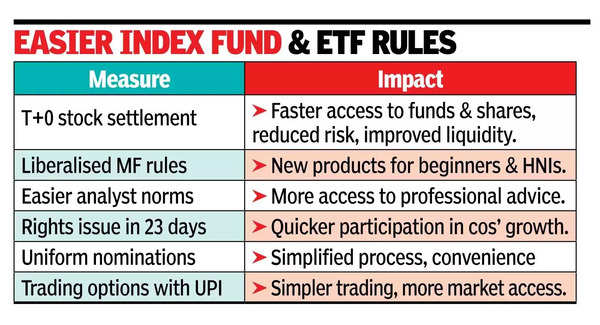

MUMBAI: In a move that will make stocks among the most liquid investments, markets regulator Sebi has proposed expanding the scope of T+0 settlement cycle to 500 shares, from 25, in a phased manner, allowing investors to get their money on the day they execute the transaction.

The board of the regulatory agency, which met for the first time since allegations were levelled against Sebi chief Madhabi Puri Buch, also cleared other major initiatives including a new asset class for high-net worth individuals that lies between mutual funds and portfolio management schemes.’Investment Strategies‘ will come with a minimum investment of Rs 10 lakh.

It will curb the rise of unauthorised schemes, promising unrealistic returns, and comes with safeguards such as no leverage, restrictions on investments in unlisted and unrated instruments, and limited derivatives exposure.

To encourage passive investment, the regulator has also cleared ‘MF Lite’, a framework with relaxed regulations for passively managed schemes like index funds and ETFs. According to Sebi an easier regulation is justified as the asset management company has negligible discretion in such schemes. This is expected to make it easier for new fund managers to enter the market and offer passive investment options to investors. Further promoting ease of investment, Sebi has eased the regulatory framework for investment advisers and research analysts, reducing qualification requirements and encouraging more individuals to enter these professions. In the primary market, Sebi will streamline rights issue processes to 23 working days, making it one of the fastest ways for a company to raise capital.

The decision to expand the scope of the T+0 cycle is seen as a major change, which was first introduced in a small set of shares, but the regulator decided to increase the ambit following a successful initial deployment, making India perhaps the only large market to offer this kind of liquidity to investors.

All registered stockbrokers can now offer this to their clients, potentially charging different brokerage fees for it. Qualified Stock Brokers (QSBs) and custodians will need to update their systems to support T+0, with a flexible implementation timeline. This will allow institutions like FPIs and mutual funds to participate in T+0 settlement. Additionally, a new block deal window will be introduced for T+0 trades. However, the move to instantaneous settlement is on hold, and T+0 will continue to co-exist with the standard T+1 settlement.

The regulator has also introduced a relaxed regulatory dispensation for index fund managers. The much-anticipated board meeting, however, did not review the futures & options regulations and the 23-page statement was silent on discussions on HR issues.

For investors, Sebi has introduced new trading options, giving investors the choice to trade in the secondary market using either the UPI block mechanism or a 3-in-1 trading account facility, simplifying the trading process and enhancing investor convenience. Other measures include ensuring pro-rata rights for investors in alternative investment funds.