Tata group company Titan, which agreed to purchase CaratLane founder Mithun Sacheti‘s stake in the omnichannel jewellery retailer for Rs 4,621 crore, is expected to buy employee stock options (ESOPs) held by CaratLane employees for around Rs 340-350 crore, or approximately $42 million, people aware of the discussions said.

The company has around 1,700 employees, and its ESOP pool holds around 1.5% stake. Following the purchase of Sacheti’s 27.18% stake in CaratLane, Titan will hold a 98.28% stake in the company. The deal valued CaratLane at Rs 17,000 crore, or around $2 billion.

The remaining stake is held by current and former employees of CaratLane, and senior management officials of Titan, according to information sourced from Tracxn.

Titan’s purchase of ESOPs from CaratLane employees is in addition to Sacheti’s payout.

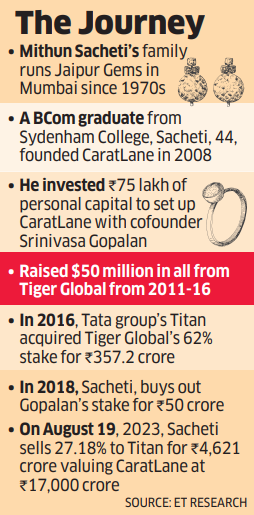

Titan had first bought a 62% stake in CaratLane in 2016 at a valuation of about Rs 563 crore. Between 2016 and 2019, it bought shares of the omnichannel retailer in tranches, spending a total of Rs 440-450 crore, through primary and secondary fund infusions, raising its stake to over 70%.

The transaction marked the second-largest exit for an ecommerce founder in India after Flipkart founders Sachin and Binny Bansal sold their stakes in the company to Walmart.

In FY23, CaratLane recorded a turnover of Rs 2,177 crore, a 72% jump from the previous year. In FY21, it posted a revenue of Rs 723 crore.

The company has been reporting a positive profit before tax number for the past three financial years, growing at a 55% compound annual growth rate (CAGR) over a five-year period.

The development about CaratLane’s ESOP stake buy was first reported by online news portal The Arc.

The ESOP buyout by Titan follows a series of stock option buybacks by Indian consumer internet companies. On July 24, food delivery firm Swiggy announced the second tranche of an ESOP buyback programme, cumulatively worth up to $50 million, or around Rs 409.4 crore.

Around 2,000 employees, including those who transitioned from Dineout after its acquisition by Swiggy, were eligible for the second tranche of the two-year liquidity programme initiated in June last year.

Swiggy’s ESOP buyback was preceded by a $700 million ESOP buyback by ecommerce firm Flipkart last month, as part of a $1.5-2 billion funding round in PhonePe.