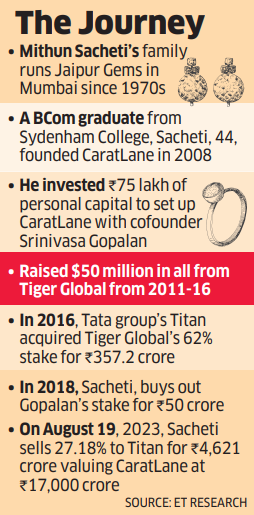

Mithun Sacheti founded online jewellery selling platform CaratLane in 2008 along with Srinivasa Gopalan. On Saturday, he scored one of the most successful exits by an Indian consumer internet entrepreneur when he sold his 27% stake to watchmaker Titan for Rs 4,621 crore.

Sacheti, 44, first brought the Tata group company in as a shareholder in 2016, when existing investor, New York-based investment fund Tiger Global, sold its 62% stake in CaratLane to Titan, in a deal that valued the startup at Rs 536 crore. On August 19, Titan ascribed a valuation of Rs 17,000 crore to the omnichannel retailer, an over 30-fold jump in seven years.

Sacheti, whose family runs Mumbai’s well-known jewellery store Jaipur Gems, stayed away from the media limelight as he quietly built the Chennai-based company. He spoke to ET’s Samidha Sharma and Digbijay Mishra about the CaratLane journey, his first institutional investment from Tiger Global in 2011, and about increasing the value of the business exponentially under a strategic such as the Tata group. Edited excerpts follow:

Titan’s acquisition of your entire holding has been in the works for a while; how was the valuation arrived at?

It was a negotiated value. There’s no role for a banker at first, because … the buyer and seller … were known to each other. The role of the banker is to educate the buyer and seller about how to go about the valuation. I have never sold a business and Titan has never bought anything like this before. But there were so many public multiples available on CaratLane, because in some parts of Titan that data is available, and we were clear that we had to be closer to that. And, as a buyer, they have the prerogative to basically negotiate.

Between 2016 when Titan first invested and your exit now, there has been a massive jump in valuation. Did you expect this outcome?

I didn’t think of the value, frankly. But when I started CaratLane, my goal was to build a Rs 100 crore business. I think your goals are just milestones in your journey. And you keep reaching them as time goes by, you keep resetting.

Ecommerce businesses were very few at the time in India, how hard was it back then?

I didn’t realise the kind of money it would take to build an ecommerce business. You’re sort of naive and do not realise what challenges will come forth. I had no reference point at all in India. I was looking at Blue Nile in the US. My exposure levels were very low and I just knew the power of the internet as a user; I didn’t know it as a business builder. But in the first year, I realised I would need to stay in this business long.

It’s been quite a journey for you from Jaipur Gems, a traditional jewellery store to building CaratLane…

It was in 2008 that I started CaratLane. My background, my entire experience, was of running a family shop (Jaipur Gems). I was a shopkeeper—I started from there. And then there was this feeling that I make great jewellery, but family jewellers in India cater to the classes; they want to go higher and higher in their average selling price, that’s when they feel they’ve arrived. I realised that the number of customers I was serving was 3,000. It’s not an exciting number if you think about it from what it takes to build a business. So, I decided I had to do something different. The best way to do that was on the internet, because you can reach more people on the internet than you can reach anywhere else. That’s how CaratLane was born in 2008.

How did Tiger Global invest in CaratLane back in 2011?

By 2011, we got lucky and raised money from Tiger Global. Frankly, I used to beg every venture capital fund, every single month in Bangalore, and everyone would say, “It’s good progress, come back next month”, and nothing happened. (And then) In typical Lee Fixel (head of private investments at Tiger Global) style, I got a LinkedIn request saying, “Hey, I’m from Tiger Global, running a $14 billion fund…” At that time, I thought it was a Nigerian scam (laughs). There was no website for Tiger Global. Here comes this guy (Fixel), signs deals with Flipkart, Myntra. So, I went to meet him in New Delhi and one hour into the meeting, he had more data on my business than I had on my own. Then, we agreed that he would give us a $6 million term sheet (an agreement for a deal). After that, there was no looking back.

I also had to fly to New York to meet Chase Coleman (founder of Tiger Global) and his mentor Julian Robertson (founder of Tiger Management).

Post 2011, what was the business trajectory?

Our consumer business was about Rs 12 crore then and we had a B2B vertical—both put together, we were at about Rs 40 crore of revenue. Then Tiger happened, and the business kept growing steadily till 2016. There were two more rounds of funding. In total, we raised about $50 million from them. I had only one investor.

Why was that?

I felt that if you looked at the number of users, I was always going to have a small number because that’s the nature of the industry. I’m at 1 million customers this year, whereas all venture investors talk about large numbers. I realised in 2013-2014, after raising funds, that I burned an unnecessary amount of money chasing and trying to be like Myntra or Flipkart. I could never be like them.

How were you thinking about the business after raising $50 million from Tiger?

In 2015, Bhaskar Bhatt (MD of Titan Industries at the time) came to Chennai to see CaratLane. I would ask him every time when we were raising a round if Titan could participate but I had never received a response till that time. He visited our office and saw the way we thought about business, which was different from Titan or Tanishq. At the end of the day, he felt like this is the place he wanted to invest in. He said for the first time he had visited a jewellery business where he was learning something. He reiterated that to me today (after signing the deal). I had to convince Lee Fixel (in 2016), who had just pumped in $30 million, to exit the company.

Was Tiger keen on exiting then?

No, they were not keen on it. I wrote an email to Lee (Fixel), saying that a fund has ten lives, an entrepreneur has three lives but a business has only one. Rs 200 crore of capital cannot build the kind of trust a Tata name builds. So, we should really allow them to come in. And after that, we’ll build a great business and everybody will see a great outcome. He agreed to it after the emotional plea. In 2016, we were at Rs 140 crore of revenue and Titan came in and bought out Tiger at a valuation of Rs 563 crore. We were making about Rs 30-35 crore annual losses then. Tiger owned 62% and they sold their entire holding in a fully secondary deal. They made a 15% return, nothing major at the time. The idea was not for them to sell but to create value. But all of a sudden, due to the turn of events, Tiger ended up selling everything. It didn’t play out as well as expected.

What was the next phase like for you under Titan?

CaratLane’s cofounder Srinivasa Gopalan, who had worked at technology firm Sify, held an 8.5% stake, which I bought out in 2018. I also met my mentor-friend, Rakesh Jhunjhunwala, through Titan, where he was a big shareholder. We started building from that point with new energy. In 2018, we raised Rs 99 crore from Titan. While we had done well for ourselves—growing revenues from Rs 140 crore to Rs 414 crore—in two years, we were still loss-making. I realised at that point that loss-making businesses don’t have great value in the eyes of strategics. Titan invested at about a Rs 900 crore valuation. We were disappointed and realised that day that from now on, we were only going to build a profitable business. The current MD of Titan, CK Venkataraman, was extremely helpful in making the business profitable. And that was a watershed moment for us. From then on, we managed a 55% CAGR (compound annual growth rate). Last year, we clocked Rs 160 crore of Ebitda (earnings before interest, taxes, depreciation), and about Rs 2,200 crore in gross revenue.

What role did Jhunjhunwala have in how you built CaratLane?

I remember going to meet him and he was like, what is this nonsense? He said, I don’t believe in these loss-making businesses. But over a period of time, we explained to him how this can make money and then it made sense to him, and he backed me a lot. In 2017, I told him how it’s very difficult to work with a strategic investor as I was really struggling working with Titan. I was not able to find my feet in the company.

Bhaskar Bhatt and Irina Vittal, who were on the board of Titan, also counselled me. Around that time I was invited to meet a couple of illustrious people from the stock markets—Ramesh Damani and Raamdeo Agrawal (chairman of the Motilal Oswal group) I went there thinking I will tell him (Jhunjhunwala) that I might want to sell my stake in CaratLane. But he convinced me to not sell and instead acquire the stake held by my cofounder, who was not operating the business. It was a good outcome for both of us. I borrowed Rs 50 crore to buy him (Srinivasa Gopalan) out. It was a great outcome for him as he had invested just Rs 26 lakh.

What is it like to build under strategics versus financial investors?

What a strategic brings is absolute focus on the health of a business, whereas a fund brings focus on scaling your business. The value creation that has happened for us is because of the role that both Bhaskar Bhatt and Venkataraman played. Without that, I don’t think we would be where we are.

What’s next for you after the big cash exit?

Investing is something I’ve always enjoyed and I’m very excited about doing it full time. What I’m trying to figure out is how to become a large LP (limited partner) in a fund because I don’t think I have the skill set to be a general partner (GP) yet. I am working with Sailesh Tulshan at 021 Capital (early-stage venture fund) along with Binny Bansal (Flipkart founder). I’m also trying to solve for fungibility and storage through Oro Money, which has raised funds from Premji Invest, Three States Ventures and Singularity Ventures. While I am the architect of the business, for operations, there are three other founders, who run it completely.