MUMBAI: Finance minister Nirmala Sitharaman on Monday called for bank interest rates to be “far more affordable”, arguing that several people found the cost of borrowing “very stressful”.

Making a case for lower lending rates, she said that India required its businesses to ramp up and invest in new facilities so that the goal of “Viksit Bharat” can be achieved.

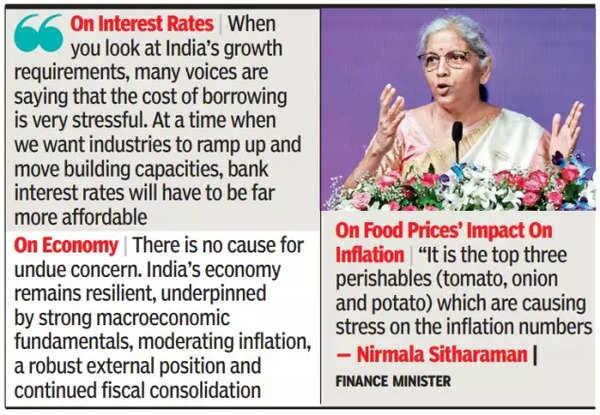

“When you look at India’s growth requirements, many voices are saying that the cost of borrowing is very stressful. At a time when we want industries to ramp up and move building capacities, bank interest rates will have to be far more affordable. So, we need to have a lot more conversation on this,” Sitharaman said at the SBI Conclave on Monday. She also called for more discussion on using interest rates to control food prices and sought to comfort the market by stating that govt was taking measures to address food supply issues to prevent price spikes.

“It is the top three perishables (tomato, onion and potato) which are causing stress on the inflation numbers, while for the others, the numbers are the low 4s (percentage points) or the higher end of 3s. I do not want to get into this debate of whether perishables should be part of the inflation measure index and whether it is just a supply chain or demand-supply problem,” she said. However, she went on to add that there are periodic and cyclical spikes causing volatility to inflation.

The FM’s statement comes days after commerce and industry minister Piyush Goyal stated that targeting food prices through interest rates was an “absolutely flawed theory”. With Oct’s inflation reading coming in at 6.2% – outside RBI’s comfort zone – most analysts have ruled out a rate cut in Dec. The comments also coincide with concerns among companies that high interest rates and a squeeze on lending by NBFCs had slowed consumer demand.

Sitharaman sought to address the slowdown concerns arising from recent signs of moderation in some economic indicators. “There is no cause for undue concern. India’s economy remains resilient, underpinned by strong macroeconomic fundamentals, moderating inflation, a robust external position and continued fiscal consolidation,” she said.

She also flagged the issue of mis-selling of insurance by banks, adding that they should focus on their core business of raising deposits and lending. Sitharaman said that mis-selling contributed in indirect ways to increased consumer borrowing costs.

Sitharaman’s comments come at a time when banks are struggling to grow their deposits at the same pace as credit. There is a lot of commentary on the shift of the customer focus from being a saver to an investor. In recent years, banks have been pushing insurance investment products, encouraging customers to buy policies as the commission was much higher than the margin that banks would earn if the funds were parked with the banks as deposits.

Despite banks emerging as the biggest distributors of insurance policies, there has not been a single case of a bank being penalised for mis-selling of insurance.