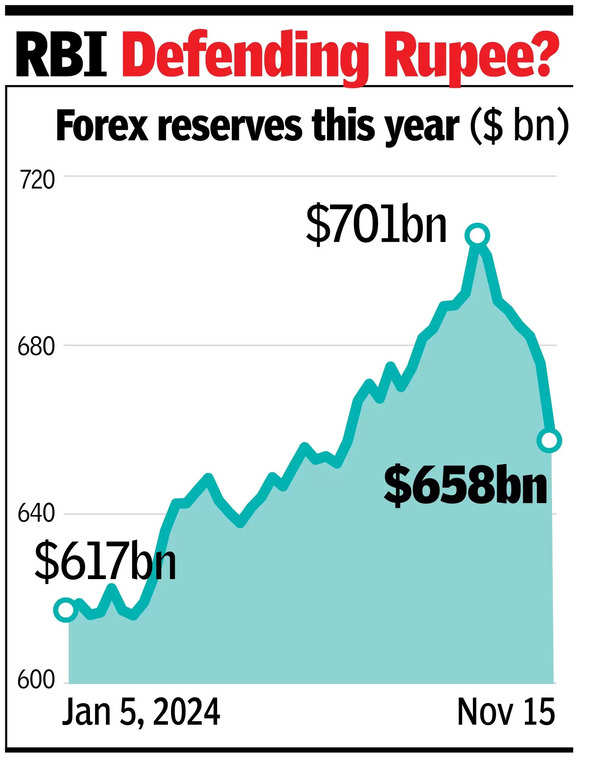

MUMBAI: Foreign exchange reserves fell by nearly $18 billion in the week ending Nov 15-the sharpest fall on record-as global investors continued pulling out funds from Indian stock markets.

According to RBI data, forex reserves declined by $17.8 billion to $657.9 billion during that week. The decline was largely due to a $15.5 billion drop in foreign currency assets to $569.8 billion, coupled with a $2 billion decrease in gold reserves to $65.7 billion.

Reserves had peaked at $704.9 billion on Sep. 27, falling by $47 billion over the next 49 days. Dealers indicated that this drop reflects the scale of the central bank’s intervention in the forex market, supplying dollars to meet demand from exiting foreign portfolio investors selling in equity markets.

While the decline in reserves signals RBI’s intervention, it does not fully represent dollar sales, as the data also reflects changes in the value of foreign currency bonds and non-dollar assets when converted to dollar terms. Dealers estimate revaluation losses would be less than $10 billion.

Current forex reserves are sufficient to cover 11 months of imports. “Import cover should not be the sole metric for measuring forex adequacy. The key measure now is the reserves’ capacity to handle foreign portfolio outflows,” said a dealer.