MUMBAI: After global ratings majors Moody’s and Fitch revised downwards their outlooks on several Adani group stocks due to governance risks, group companies’ stocks witnessed a fresh bout of intense selling on Tuesday. As a result, the Gujarat-headquartered conglomerate has now fallen to the sixth rank among the most valued business groups in India, down from four last week and behind Bajaj and ICICI groups.

Moody’s and Fitch revised their outlooks downwards on some Adani group companies after the US Department of Justice and Securities Exchange Commission last week indicted the group’s chairman Gautam Adani and seven others of bribery to win businesses, as well as wire and securities frauds in the US.

The group’s stocks also were hit because of the decision by France’s TotalEnergies – a global alternate energy major – to put any future investments in the group on hold till there is clarity about the ongoing cases in the US.

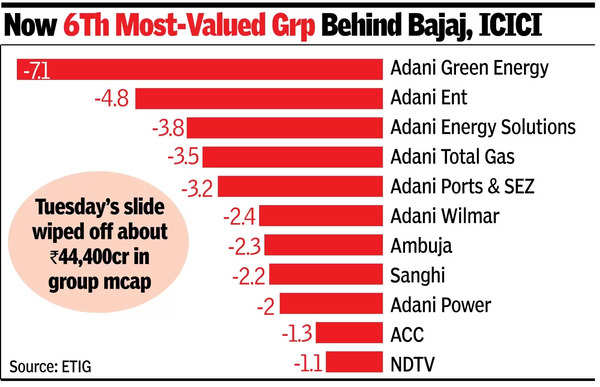

In Tuesday’s market, group flagship Adani Enterprises fell by nearly 4.8%. Among others, Adani Green Energy’s stock price fell by 7.1%, Adani Energy Solutions lost 3.8%, Adani Total Gas 3.5% and Adani Ports 3.2%. The day’s slide in stock prices wiped off about Rs 44,400 crore worth of market capitalisation for the group, with the aggregate value now at nearly Rs 11.4 lakh crore. In comparison, the Bajaj group is now worth Rs 11.7 lakh crore and the ICICI group stands at a little over Rs 11.4 lakh crore, BSE data showed.

The slide in market cap also pushed group chairman Gautam Adani’s net worth down by about $2.4 billion (Rs 20,200 crore) to $53.7 billion (Rs 4.5 lakh crore) on Tuesday, according to Forbes data, making him the 27th richest in the world – down from 25th last week.