MUMBAI: Markets regulator Sebi plans to use government’s DigiLocker system to reduce instances of unclaimed assets in the securities market. This includes MF folios and stocks left with fund houses and depositories after the death of an investor.

The regulator has proposed that fund houses and depositories should provide demat and MF holding statements on DigiLocker. Sebi also wants KYC Registration Agencies (KRAs) to share information on an investor’s demise with DigiLocker.

By integrating DigiLocker with the process of transferring these assets to the rightful heirs, Sebi intends to minimise unclaimed assets in the securities market. It has come out with a draft circular on this issue and has asked for public comments by December 31.

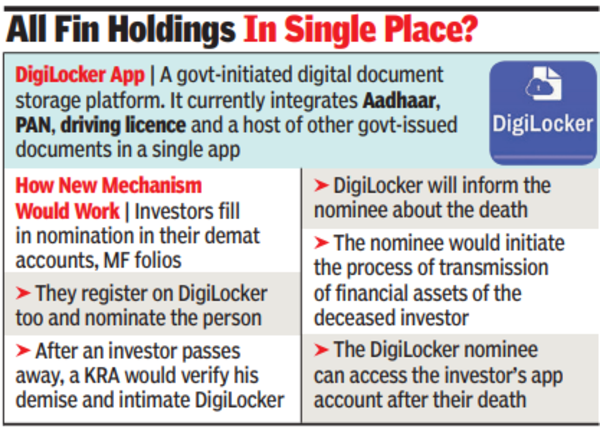

DigiLocker is a govt-initiated digital document storage platform that currently integrates Aadhaar, PAN, driving licence and a host of other govt-issued documents on a single, digital app.

In December 2020, govt notified to integrate bank accounts, insurance policies and statements of new pension schemes on the DigiLocker platform. “The proposed inclusion of MF and demat holding statements within DigiLocker can make available the entire financial holdings of individuals in a single DigiLocker account,” Sebi’s draft circular noted.

In October 2023, Sebi had initiated a centralised process for reporting the death of an investor through the KRAs. The proposed method of integrating the same with DigiLocker aims to further smoothen the process. Currently, DigiLocker users have the option to nominate individuals for their accounts. Sebi now wants KRAs to also share information about an investor’s death with DigiLocker, after verifying such information.

“At Sebi’s instance, the Digital India Corporation (DIC) has created a mechanism where the DigiLocker system automatically notifies the DigiLocker Nominee(s) about demise of the user through SMS and e-mail,” the draft circular said.