MUMBAI: Hindenburg Research, the US-based short-seller whose reports had shaved off about $140 billion from Adani Group‘s market valuation in early 2023, pushed the Indian govt and markets regulator Sebi on the backfoot, and left Indian investors divided whether to support it or oppose, is winding down. Calling Adani’s businesses “the largest con in corporate history”, Hindenburg had alleged corporate malfeasance including stock price manipulation, cooking its books and other frauds.

Saif Ali Khan Health Update

The group had denied all the allegations.

Hindenburg had also targeted Sebi chief Madhabi Puri Buch and her husband Dhaval, alleging the duo of investing in the same offshore funds that the Adani Group had used to manipulate their stock prices. The couple had denied those allegations.

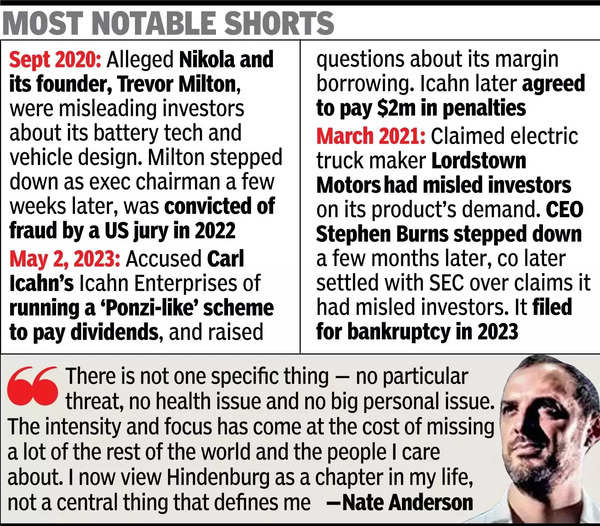

Announcing the decision on Wednesday night, founder Nate Anderson said he viewed “Hindenburg as a chapter” in his life, and “not a central thing” that defined him.

In Nov 2024, Adani and some of his associates were indicted by two US govt arms. The US department of justice and the Securities Exchange Commission alleged that Adani Group executives and their associates had committed wire frauds and misled investors as the conglomerate was paying about $220 million to Indian govt officials to win business.

Shook some empires that needed shaking, says Hindenburg founder

Over the next six months, Anderson said he would be working to release articles and videos to open-source how the team went about their business of investigating corporate frauds, corruption and malfeasance across the world. Since its founding in 2017, “nearly 100 individuals have been charged civilly or criminally by regulators at least in part through our work, including billionaires and oligarchs. We shook some empires that we felt needed shaking,” Anderson said in his note.

Almost two years to the date, Hindenburg had released a 110-page report on the Adani Group alleging various types of corporate malfeasance. Following the report’s release, over the next five weeks, about $140 billion worth of the group’s market value was lost. As a result, as the net worth of Gautam Adani, the group’s chairman, fell, his ranking in the Forbes billionaire list went down from third richest in the world to out of the top 25th.

Last Aug, Hindenburg had released a report against the Sebi chief. “We find it unsurprising that Sebi was reluctant to follow a trail (in the Adani affair) that may have led to its own chairperson,” the Hindenburg report said.

After the report was published, several opposition lawmakers demanded Sebi chief Buch’s resignation while the BJP-led governing coalition at the Centre backed her.

In Nov 2024, Adani and some of his associates were indicted by two US govt arms. The US department of justice and the Securities Exchange Commission alleged that Adani Group executives and their associates had committed wire frauds and misled investors as the conglomerate was paying about $220 million to Indian govt officials to win business. The Adani Group has denied the allegations.

Although DoJ and SEC indictment papers didn’t mention Hindenburg’s research reports against the Adani Group, Indian lawmakers and market players tried connecting the two.