NEW DELHI: Finance minister Nirmala Sitharaman is set to introduce a bill for a new direct tax law in the budget session, which will focus on simplification of the provisions, doing away with the ones that are redundant and attempt to make the language more layman friendly.

The committee tasked with the revision, is deciding if the new law to replace the 63-year-old Income Tax Act will be in two, if not three parts, sources told TOI. Although govt had indicated that the draft law by the panel of officers will be released for public comments, it has decided to send a strong message at a time when it is facing flak for complicated tax laws and will introduce the bill, which can then be tweaked based on feedback from taxpayers and experts.

As a result, officials from finance ministry and PMO worked closely with the panel over the last six-eight weeks so that it is ready by the time the budget is presented.

Sitharaman, who announced the move in the July Budget, is expected to mention the legislation in her speech on Feb 1, although it is yet to be decided if the bill will be tabled in the first half or the second half of the session.

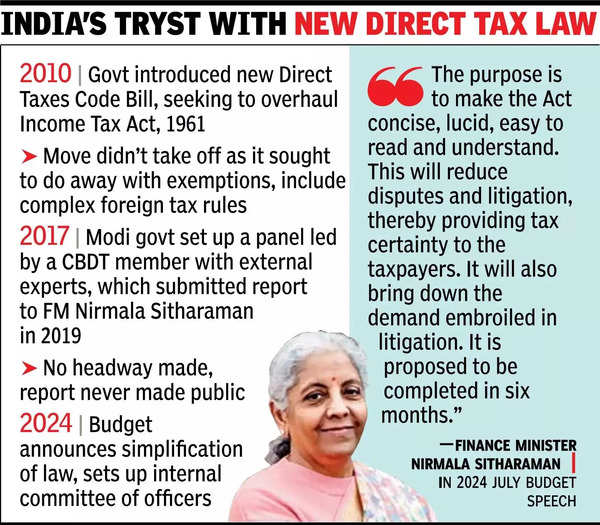

This is at least the third attempt to rewrite the Income Tax Act since the Direct Tax Code bill was introduced in Parliament in 2010. Subsequently, the Modi govt had set up a panel of experts, whose reports were not made public and the recommendations were largely not taken on board.

The committee has been asked to ensure that “provisos” in law, and there are thousands of them, are removed in the new legislation.

Similarly, there are several sections, which have been made redundant as those clauses have been dropped from the I-T Act over the years, which are being excluded. “The language itself can be difficult to understand for the common man and the committee has been asked to make it as simple as possible,” a source said.

But, govt is not including new issues in the proposed legislation, at least for the moment. Officials, however, cautioned that a change in language can be a source of litigation as taxpayers would want fresh interpretation in several cases.