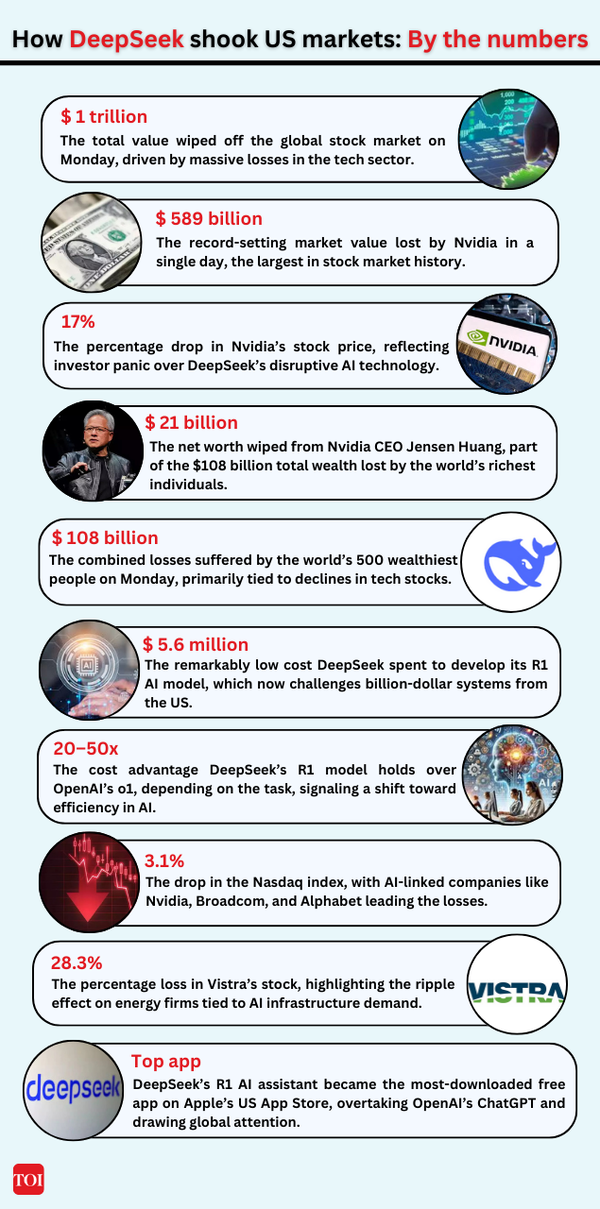

For over two years, artificial intelligence (AI) has driven one of the most dramatic stock market rallies in history. Nvidia, the chipmaking giant and cornerstone of the AI revolution, became synonymous with the soaring optimism surrounding AI’s potential to reshape industries. Yet, on Monday, this euphoria came to a screeching halt. Nvidia suffered a historic $589 billion loss in market value—the largest one-day drop for a company in Wall Street history—sparking widespread panic in the tech-heavy Nasdaq index and wiping nearly $1 trillion from global markets.

Poll

Is DeepSeek’s AI Technology Superior to Other Available AI Tools?

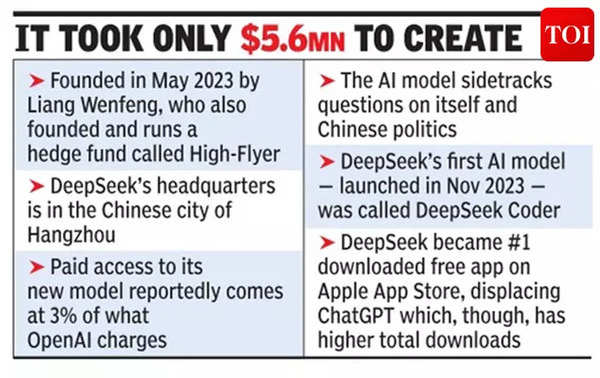

The trigger? A Chinese startup called DeepSeek, which last week announced a breakthrough in AI technology that threatens to upend the economics of the industry. The Hangzhou-based company introduced its R1 AI model, claiming it could rival the most advanced models from Silicon Valley titans like OpenAI and Google—for a fraction of the cost. The disruptive potential of DeepSeek’s innovation rattled investor confidence, sending ripples through the global tech ecosystem.

Why it matters

- DeepSeek’s announcement is more than a technological milestone—it’s a direct challenge to Silicon Valley’s dominance in AI. For years, US companies like OpenAI and Google have relied on their ability to spend billions on AI infrastructure and development, creating an almost unassailable competitive moat. Nvidia’s dominance in AI chips has fueled a skyrocketing valuation, with its GPUs seen as indispensable for training large language models (LLMs).

- But DeepSeek’s revelation threatens to undercut this economic model. By demonstrating that high-performing AI models can be developed cheaply using fewer resources, the company has thrown into question the sustainability of these enormous capital expenditures. If the cost of training AI drops significantly, demand for high-end GPUs, advanced data centers, and specialized cloud services could fall, upending the financial prospects of US tech titans.

A $1 trillion fallout

Monday’s selloff was nothing short of catastrophic. Nvidia’s stock plummeted 17%, marking its lowest point since October and shaving billions off the fortunes of its investors. CEO Jensen Huang alone lost $21 billion from his net worth. Broadcom, another major player in AI chips, saw its shares fall 17.4%, while Alphabet, Microsoft, and Meta faced declines ranging from 2% to 4%. Even power utility firms like Vistra and Constellation Energy, which are critical to the data center infrastructure powering AI, saw their stocks fall by 28.3% and 20.8%, respectively.

The Nasdaq Composite dropped 3%, dragging down the broader S&P 500 tech sector, which fell 5.6%. This was the sector’s worst one-day decline in over four years. By the end of the day, the global market had shed a staggering $1 trillion in value, a sharp reversal of the AI-driven gains that had propelled stocks to record highs over the past two years.

The rise of DeepSeek

DeepSeek, once an obscure startup, emerged as a serious player in the global AI race last week when it announced the release of its R1 model. According to the company, the R1 model can match the performance of OpenAI’s GPT-4 and other leading models while costing just $5.6 million to develop—a fraction of the hundreds of millions or even billions spent by U.S. firms. The company also claimed to have achieved this feat using Nvidia’s less powerful H800 chips, a move born of necessity due to U.S. export restrictions on more advanced GPUs like the H100.

The timing of DeepSeek’s announcement could not have been more significant. Its AI chatbot, integrated with the R1 model, quickly became the most downloaded app on Apple’s US App Store, overtaking OpenAI’s ChatGPT. For Silicon Valley, the implications were clear: China had found a way to compete in the high-stakes AI game without the massive capital investments and infrastructure traditionally required.

DeepSeek’s “Sputnik moment”

- The scale and efficiency of DeepSeek’s breakthrough have led to comparisons with the Soviet Union’s launch of

Sputnik in 1957—a moment that catalyzed the space race. Silicon Valley heavyweight Marc Andreessen called the R1 model “AI’s Sputnik moment” and “one of the most amazing breakthroughs” in the field. Even President Donald Trump weighed in, describing the development as a “wake-up call” for US industries. “Instead of spending billions and billions, you’ll spend less, and you’ll come up with hopefully the same solution,” he said. - In China, DeepSeek’s success was hailed as a national triumph.

Zhou Hongyi , the CEO of Chinese cybersecurity firm Qihoo 360, declared that the company had “upended the world.” Others called it proof that China was closing the gap with the U.S. in AI technology. The breakthrough has renewed confidence in Beijing’s ability to outmaneuver U.S. sanctions and technological barriers.

Skepticism and controversy

Despite the dramatic market response, not everyone is convinced of DeepSeek’s claims. Analysts like Stacy Rasgon of Bernstein and Atif Malik of Citigroup have questioned whether the R1 model can truly rival US counterparts at such a low cost. They pointed out that while DeepSeek may have used less advanced hardware, its ability to achieve cutting-edge performance without significant investments in GPUs remains debatable.

There are also suspicions about how DeepSeek obtained its hardware. Elon Musk, who has heavily invested in Nvidia chips for his company xAI, speculated that DeepSeek may have acquired banned H100 chips through indirect channels. Alexandr Wang, CEO of Scale AI, echoed this sentiment, claiming that Chinese firms “have more H100s than people think.” Nvidia, however, stated that DeepSeek’s technology was “fully export control compliant.”

Impact on Silicon Valley’s AI giants

The broader implications of DeepSeek’s rise are significant for U.S. tech companies. For years, firms like Nvidia, Microsoft, and OpenAI have built their dominance on the premise that AI requires immense capital expenditure. Nvidia, for instance, has sold billions of dollars’ worth of high-end GPUs, becoming a linchpin of the AI revolution. But if DeepSeek’s claims hold, the demand for such hardware could decline, undermining the economic model that has driven the industry’s explosive growth.

Nevertheless, some industry leaders see opportunity in DeepSeek’s innovation. OpenAI CEO Sam Altman called the R1 model “an impressive competitor” and pledged to accelerate his company’s product releases. Microsoft CEO Satya Nadella argued that cheaper AI would democratize access and drive broader adoption, potentially benefiting the global economy.

The new economics of AI

DeepSeek’s announcement has forced a reevaluation of the economics of AI. For years, the development of large language models (LLMs) has been characterized by ballooning costs and resource-intensive processes. OpenAI’s GPT-4 reportedly cost over $100 million to train, while Anthropic CEO Dario Amodei suggested that some models are approaching $1 billion in development costs.

In contrast, DeepSeek has demonstrated that advanced AI can be developed at a fraction of the cost, potentially reshaping how companies approach AI investments. This shift could benefit smaller players and startups, but it also raises questions about the billions already spent by Silicon Valley giants on data centers and infrastructure.

Geopolitical implications

DeepSeek’s success has broader geopolitical ramifications. The US has sought to curb China’s AI development through export controls and sanctions, limiting access to cutting-edge chips and technology. However, DeepSeek’s achievements suggest that these measures have not only failed but may have spurred innovation. By focusing on efficiency and resourcefulness, Chinese firms like DeepSeek are proving that they can compete with—and possibly surpass—their US counterparts.

President Trump’s administration may now face pressure to tighten export restrictions further, a move that could escalate tensions with Beijing. At the same time, policymakers will need to consider how to foster innovation at home while maintaining a competitive edge.

A turning point for markets

For investors, Monday’s selloff serves as a stark reminder of the risks associated with overexposure to a single narrative. The AI boom, while transformative, has also fueled speculative behavior, with tech stocks reaching valuations that some argue are unsustainable. Bret Kenwell, an investment analyst at eToro, urged caution, noting that “panicking rarely makes for a good investment decision.”

Yet, others see a silver lining. Lower costs could make AI more accessible, driving widespread adoption across industries and fueling long-term economic growth. As Joseph Amato of Neuberger Berman put it, “If you can invest less for a powerful model that has wider adoption, that’s got to be a good thing for the broad-based economy.”

(With inputs from agencies)