The new tax regime proposed in Budget – with a tax rebate of Rs 60,000 on income up to Rs 12 lakh (and Rs 12.75 lakh for salaried people) – leaves the old tax regime, with three slabs of 5%, 20%, an 30%, with little appeal, even with all the deductions against investments in tax savings scheme from gross income.

The finance ministry has long endeavoured to delink savings schemes from tax liability so that taxpayers can make an independent and informed choice, solely to maximise their benefits.

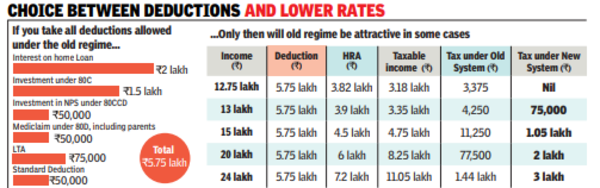

For income up to Rs 12 lakh (Rs 12.75 lakh for salaried people), new tax regime is better than the old even if one is availing maximum possible deductions of Rs 5,75,000 and 30% of salary as house rent allowance (see chart). However, it is purely theoretical for someone earning Rs 12.75 lakh to invest in tax savings schemes, avail HRA (Rs 3,82,500), and standard deduction, chalking it up to Rs 9,57,000.

However, as the tax incidences under the new scheme go up sharply after the Rs 12 lakh level, the decision to pay tax under the old regime would make sense only if the taxpayer invests Rs 5.25 lakh in tax saving schemes.

Even if the taxpayer with income of Rs 13.75 lakh does not avail of HRA, his tax liability at Rs 57,500 under old system will be lower than the outgo of Rs 75,000 under the new regime. Same is true for income up to Rs 15.75 lakh, where the tax liability without HRA in the old system will be lower than the new regime but the rider of Rs 5.25 lakh investment in savings schemes holds. Even with HRA, old regime would be a better choice.

The picture changes at incomes of Rs 20 lakh (Rs 20.75 lakh for salaried) where new tax regime will be beneficial over the old. Setting HRA aside, a taxpayer’s liability on income of Rs 20 lakh will be Rs 2,40,000 under old system even after investing Rs 5.25 lakh in savings scheme, against Rs 2 lakh in the new system, where no deductions are allowed.

At the income level of Rs 24 lakh also, the taxpayer will save Rs 60,000 under the new regime. Under the old system, his tax liability after investing the maximum possible of Rs 5.25 lakh in savings schemes will be Rs 3.60 lakh as against Rs 3 lakh in the old scheme.

Above the income of Rs 15,75,000, if a taxpayer is claiming HRA of more than Rs 3 lakh, he should opt for old tax system provided he invests Rs 5.25 lakh in savings schemes.