D-Street Smart: Volatility drives investors from thematic schemes to hybrid funds

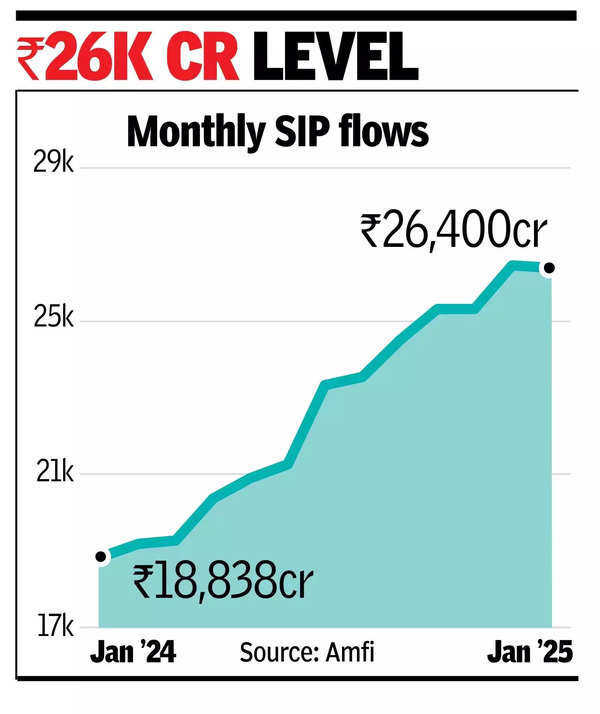

MUMBAI: Retail investors continued to pour money into mutual funds in Jan despite a volatile stock market. Monthly gross SIP inflows remained steady above Rs 26,000 crore in Jan, industry body Amfi’s data showed. The volatile market conditions, however, prompted investors to prefer hybrid funds over thematic schemes, industry players said.

During Jan, the MF industry took in Rs 26,400 crore through the SIP route, marginally lower than Rs 26,459 crore in Dec. SIP accounts too dipped to 10.26 crore from 10.32 crore in Dec. Consequently, there was a dip in total assets under management through the SIP route: From Rs 13.6 lakh crore in Dec to Rs 13.2 lakh crore.

According to Amfi chief Venkat Chalasani, the drop in number of SIP accounts and the related AUM are due to a reconciliation process that was carried out by RTAs and the exchanges following a regulatory directive.

Data for Jan showed that net inflows through debt schemes was at nearly Rs 1.3 lakh crore and through the equity schemes at Rs 39,688 crore. Within the equity segment, although thematic schemes net took in Rs 9,017 crore, highest for the segment, it was substantially lower than Rs 15,332 crore in Dec. In contrast, hybrid funds took in a net Rs 8,768 crore, up from Rs 4,370 crore in Dec. “There is a swing in allocations from thematic funds to asset allocations funds like balanced advantage funds and multi asset allocation funds including large cap funds as a pure equity exposure,” said Akhil Chaturvedi, ED & chief business officer, Motilal Oswal MF.

The data also showed that the fund industry’s total AUM in Jan rose to Rs 67.3 lakh crore from Rs 66.9 lakh crore, despite a Rs 1.9 lakh crore net inflow. This rise in AUM of smaller magnitude is attributed to the mark to market losses due to the slide in stock prices in Jan, industry players said.