Taxpayers take note! The Income Tax Department plans to initiate a countrywide action against defaulters who have not deposited their TDS/TCS, according to officials. Based on tax deductions in FY22-23 and FY23-24, nearly 40,000 taxpayers are being investigated.

A comprehensive 16-point strategy has been formulated by the Central Board of Direct Taxes to detect TDS defaults, whilst the data analytics division has compiled a detailed list of such taxpayers for investigation.

“We have data from the analytics team and we will reach out to such taxpayers, initially through intimation, in case they have missed out depositing tax,” a senior official told ET.

The senior official confirmed that this enforcement drive would remain non-intrusive, similar to previous initiatives.

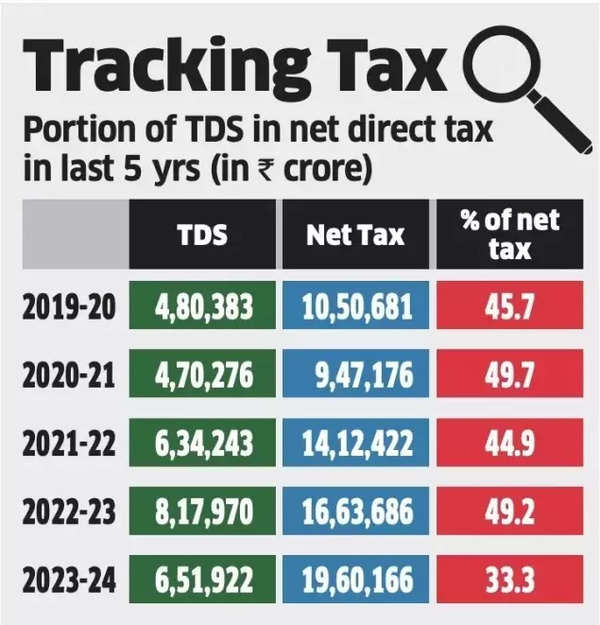

Tracking Tax

Officials will target recurring defaulters, examine instances showing significant variations between tax deduction and advance tax payment, review cases with frequent alterations in deductee details, and investigate companies using unprofitable units in their audits.

Assessing officers have been instructed to flag cases with substantial disallowance under Section 40(a)(ia) of the Income Tax Act, which prohibits deductions when TDS is not deducted or submitted to the government.

Also Read | Income tax calculation under new income tax regime: How to pay zero tax with CTC of around Rs 17 lakh by restructuring salary

Authorities will monitor situations where TDS returns are modified multiple times with considerable reduction in default amounts.

Field officers have been directed to consider deductee complaints and employ data analytics to spot trends and irregularities in TDS payments.

The Centre’s recent budget has announced simplification of TDS and TCS rates by decreasing the number of rates and thresholds for TDS deduction.

“There is a carrot-and-stick approach; while we have relaxed TDS compliance for honest taxpayers, strict action will be taken against wilful defaulters to make the tax system fair and equitable,” the official said.

Also Read | ITR filing with latest income tax slabs post Budget 2025: Will taxpayers with income below Rs 12 lakh have to file tax return?