MUMBAI: A weak rupee can be a boon for NRIs, but it is a bane for Indians studying abroad. Adding to their pain is the tightening of post-education work visa norms, which dims chances of higher pay abroad and repay loan sooner back home.

In six months, the rupee has depreciated by about 5% to 87.2 against the dollar from 83.5 in Aug. That’s an increase of Rs 5 lakh on a Rs 1-crore tuition-plus-expenses budget.

At the same time, the UK has proposed requiring international graduates to secure graduate-level jobs with salaries between 36,000-40,000 pounds to stay beyond two years. Canada too is tightening immigration rules for Indian students, by allowing officials to cancel permits and ending the Student Direct Stream visa program.

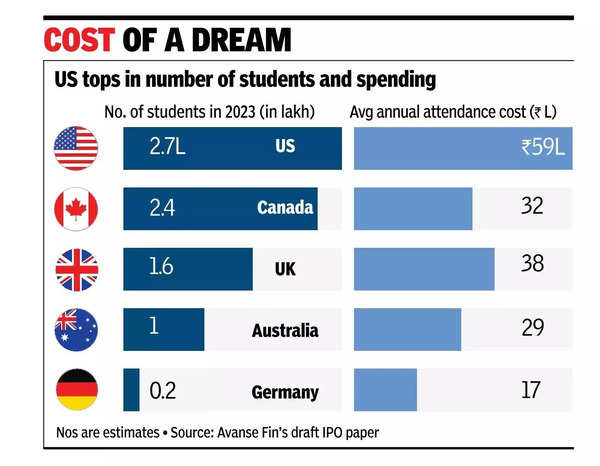

“Earlier, students used the post-education work visa to earn in dollars and repay a large part of their loans. For Indian students in undergraduate programs, the impact could be severe as their total cost of education is in excess of Rs 1.5 crore in the US,” said Ajay Bohora, co-founder of education loan company HDFC Credila.

This means either a longer repayment period or higher EMIs on their education loans, said Bohora. The weak rupee also increases costs for students flying back. According to Bohora, the higher financial burden on families will require students to be more frugal.

“I am now sending $800 a month instead of $900 for my daughter’s food & board in the US. Govt has, on top of that, put TCS, which is an additional burden. So, on my tax-paid money, I am paying tax for the second time via TCS. Though I can get a refund, it has blocked my tax-paid money for a year,” said Sudha Pai, a Mumbai resident.

“While fluctuations are a regular phenomenon, this year there has been a huge upward rise in the dollar. Coupled with the uncertainty caused by the political scenario in the wake of elections, the impact on overseas education has been huge,” said K P Singh, an education counsellor & founder, Institute of Management & Foreign Studies.

According to Karan Gupta, a career counsellor, parents can ‘lock in’ foreign exchange rates by getting a loan sanctioned early and transferring funds to the university account to hedge against depreciation. “Students should avoid foreign currency loans, as it would be more expensive to repay when they return to India. They should also apply to universities that offer financial aid and scholarships, thereby reducing their financial burden,” said Gupta.

Bohora attributes the restrictions on student work visas to “economic patriotism,” which is on the rise in the US, the UK, and Canada.

The US has signalled its intent to attract highly skilled global talent to drive technological innovation and economic growth. Indian students who want to pursue higher education in the US would have to explore emerging fields such as GenAI, cybersecurity, distributed finance, blockchain, and digital currencies to enhance job prospects.

According to Singh, students should not focus solely on traditional fields like coding and programming but should explore new-age areas. He added that those without the financial resources should not take risks by pursuing courses with limited employment potential.