Jewellery export operations in Mumbai’s crucial Santacruz Electronics Export Processing Zone (SEEPZ) are facing a serious challenge from US President Donald Trump’s plan to levy reciprocal tariffs, a senior official said. SEEPZ contributes as much as 85% of India’s diamond-studded jewellery exports to the US.

Speaking to ET, Adil Kotwal, president of SEEPZ Gems & Jewellery Manufacturers’ Association, said if Trump carries out his threat, it could severely dent exports to the US-a key market-impacting thousands of jobs.

Kotwal urged the Indian government to negotiate for a fair duty structure with the Trump administration or consider lowering import duty on US jewellery to a more reciprocal level.

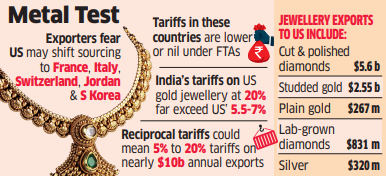

Imposition of reciprocal tariffs could prompt the US to shift sourcing to countries like France, Italy, Switzerland, Jordan, and South Korea where tariffs are lower or nil under Free Trade Agreements. Jordan, for instance, enjoys duty free access to the US, while France and Italy impose just 2.5% on US jewellery-far below India’s 20%.

For India, a key supplier of gems and jewellery to the US, reciprocal tariffs could mean levies ranging from 5% to 20% on its nearly $10 billion annual exports to the US, which could potentially lead to challenges in the sector that employs thousands of workers.

Proposed reciprocal duties by the US government on Indian gem and jewellery exports, especially coloured gemstones, could severely impact the gemstone industry in Jaipur. “The US is our largest market, and increased tariffs would likely drive business to Thailand, which has a more favourable duty structure. This would jeopardise significant US orders and threaten the livelihoods of 150,000 coloured gemstone cutters and 300,000 workers in Jaipur’s overall gems and jewellery sector,” said Alok Sonkhia, president of the Jewellers Association Jaipur (JAJ).

India’s jewellery exports to the US spans a wide range of products including cut and polished diamonds ($5.6 billion), studded gold jewellery ($2.55 billion), plain gold jewellery ($267 million), lab-grown diamonds ($831 million), and silver jewellery ($320 million). However, gold jewellery and diamonds-key drivers of exports-are likely to suffer the most.

India’s tariffs on US gold jewellery at 20% far exceed the US’s rates of 5.5-7% on Indian gold jewellery. Similarly, India levies a 5% customs duty on cut and polished diamonds, while the US applies none. Under the reciprocal plan, the US could raise tariffs on these Indian goods, potentially impacting exports.

Dinesh Lakhani, global director at Kiran Gems, said, “Reciprocal tariffs will be detrimental for India’s gem and jewellery exports as well as US jewellery retail. After two years of softness, any price inflation from tariffs would impact demand. Small independent retailers in the US and MSME exporters in Indiawill suffer most.”